With every percentage you make on your financial, you happen to be leading to the fresh new guarantee available in your residence. Now you must and work out you to household guarantee work for you using property collateral financing. I’ve flexible solutions and a fixed speed to ensure that you’re positive that your property guarantee mortgage is great to own your unique disease.

No closing co sts or running fees 1 Repayments do not were amounts for taxes and insurance costs additionally the genuine commission responsibility could be higher.

What is a house Collateral Financing

A property collateral financing try a means to borrow money away from a lender, plus mortgage was secured by the domestic. Once you happen to be approved for your house security loan, you get a lump sum regarding the number you are credit. You will then make repaired monthly installments into bank to pay straight back your property collateral financing.

Property guarantee financing as opposed to property security line of credit try your own decision based on the money you owe. That have property guarantee financing, you get the entire number requested with a fixed speed label and fee. That have property equity credit line, you have access to use the main amount today or any moment in title of line. The range get a variable price and only create payments towards count you utilize (otherwise draw) from your line.

Preferred spends away from a house Idaho personal loans Security Mortgage

It certainly is crucial that you make certain that making an application for a loan is the greatest option for the money you owe. If you are there are many the way you use a property guarantee financing, check out of the very most common spends we see out of our very own people:

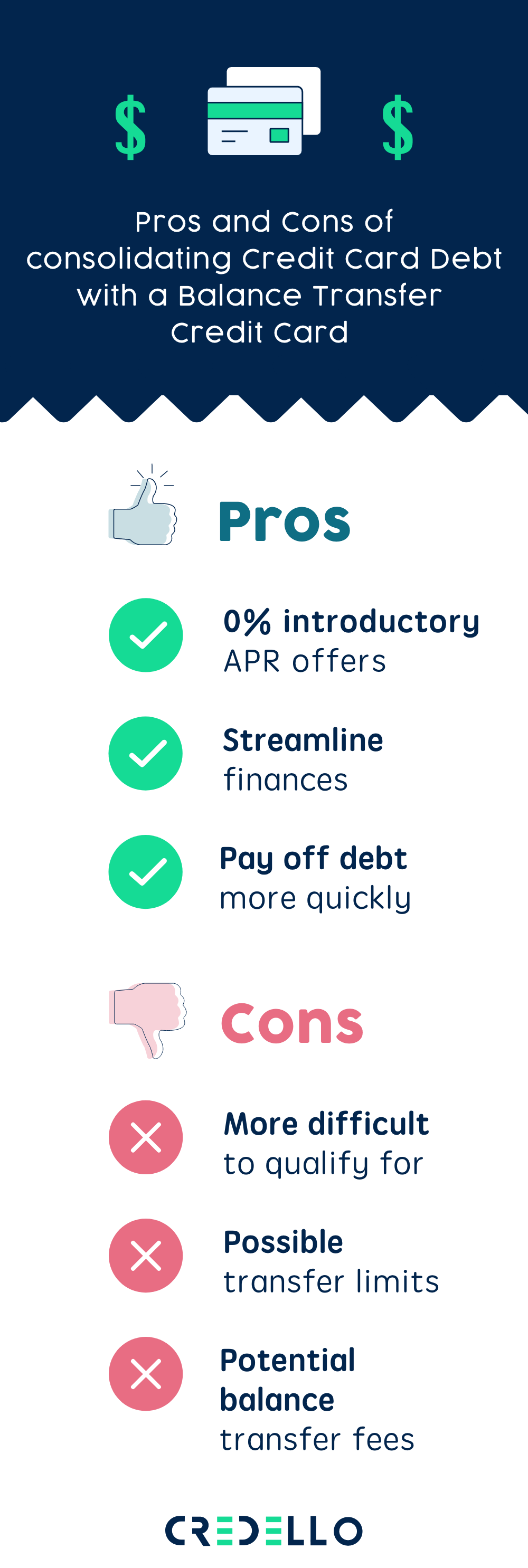

Renovations option out-of outdated so you’re able to updated by using your house guarantee to pay for big repairs otherwise upgrades Combining Obligations more often than not perhaps one of the most powerful gadgets on your own economic excursion is to try to consolidate loans toward less, cheaper monthly obligations. While the a home collateral loan is actually shielded by your domestic, prices usually are reduced than simply an unsecured loan otherwise borrowing from the bank card. Check out our debt consolidating calculator to run the amounts. Mortgage refinancing interest levels possess an everyday history of getting contradictory, which means your brand-new financial price would-be more than the newest rate you’d pay for those who re-finance your own financial for the a great household guarantee financing.

Household Equity Mortgage Rates & Has

- Available for financing numbers regarding $10,000 to $five-hundred,000 which have a fixed rate, name and you may payment

- Terms offered by 5 to help you two decades

- Borrow to 80% in your home equity since a first otherwise second lien

- Make extra repayments into the prominent in the place of penalty

- Take pleasure in an increase discount after you look for automated repayments from your own Very first Commonwealth checking account.

- Borrowing Life insurance coverage and you may Credit Handicap Insurance are around for Pennsylvania and you will Ohio individuals

Repayment Financing

The house guarantee fees financing are a flexible credit option 2 so you can put the equity of your house to help you a use.

- Readily available for loan numbers off $5,000 to $75,000 that have a predetermined speed, name and you may payment

- Acquire doing 90% of your house collateral since the an initial otherwise next lien

- Rates dismiss having automatic money from the Basic Commonwealth savings account

Applying for property Collateral Loan

You can sign up for a property collateral loan in your smartphone, tablet or notebook. We have been also offered at to open over the phone, otherwise get in touch with a neighborhood place of work in order to plan a scheduled appointment. This is what you will need when you apply for your house collateral loan:

If you were informed which you have poor credit, check this out investment before applying to see just how your borrowing from the bank affects your financial lifestyle.

Providing Prepared with property Equity Online calculator

It is important to ensure that you’re borrowing at a rate you can also be conveniently afford. While the you should have a monthly payment having a house guarantee mortgage, our very own calculators can help you dictate their payment per month considering your own rate as well as how much you need to acquire. Check out our very own Simply how much Tend to My Loan Money Be calculator to learn more.

Household Collateral Personal line of credit

Seeking the independence to attract from the financing to access dollars since you need it? Check out our home Security Line of credit.

Request More info Today

Go into your details below more resources for our house security fund and just how our team helps you fulfill your financial desires. From the deciding when you look at the, you accept discovered resources, possibilities, and you can condition away from Worldwide Borrowing Connection Financial delivered right to your own email email. We never sell or show your very own recommendations and vow not to help you junk e-mail you. You’ll be able to unsubscribe any moment.

step 1 Offer is based abreast of earliest and you will second lien funds of $25,000 in order to $five-hundred,000, a loan to worthy of up to 80% with the a holder-occupied top home, at the mercy of credit acceptance, and cannot feel a purchase-money home loan. Their genuine Apr (APR) tends to be highest considering a review of their borrowing app. To get the provided rates, at least $twenty five,000 in the brand new money and you may a primary debit out of financing payment regarding a worldwide Credit Connection Bank checking account are required. If you don’t, the rates could be high. Control and Alternative party charge between $475 to help you $915 might be reduced from the Lender. Flooding insurance is called for where expected with the security assets. In the event the an action transfer needs, identity insurance and you can attorney’s fees ples are listed below: for those who acquire $twenty five,000 shielded because of the a manager-occupied household for 120 days in the 5.99% Annual percentage rate, the brand new monthly payment might possibly be $; or you acquire $twenty-five,000 safeguarded by an owner-filled household to own 180 months on 5.99% Annual percentage rate, the fresh payment per month would be $. Fees and property insurance rates are expected on the collateral possessions while the actual fee responsibility could be deeper. Consult your income tax coach regarding the deductibility of great interest. Most other costs and you will terminology arrive. Offer appropriate to own software . Give susceptible to changes or withdrawal when.

dos Property should be based in a minimal so you can average-money census system parts because dependent on the modern 12 months FFIEC map.

Debt Excursion Issues

Once the a residential area financial, we should offer you info and you will ways to continue in your monetary trip. Simply get into their email less than and we’ll definitely help keep you up-to-date to your units to improve lifetime.

We upload monthly letters to provide the users reputation to your costs, financial information and information. We never ever offer otherwise share your very own guidance and you will hope not to junk e-mail your.