Financial Tax Deduction Calculator

You will find usually not much to obtain excited about when it comes in order to taxation seasons, with the exception of your awaited efficiency and also the write-offs you can subtract about what you borrowed from the us government.

Getting people, mortgage interest tax write-offs is a tax 12 months silver lining. Off first mortgages to help you domestic collateral-based financing, financial tax write-offs arrive under several home mortgage versions. You can determine your home loan taxation deductions while they relate with the attention you have reduced building, to purchase, otherwise enhancing your household against the taxable money.

Your house Mortgage Specialist is here to guide home owners in order to assess the loan notice write-offs he is eligible to discover. We’re going to take you step-by-step through exactly what a home loan tax deduction is actually, the latest financial information needed to estimate the deduction, and you will home loan attract deduction constraints.

Off monthly installments to help you household restoration and possession charge, the menu of quickly-obtained costs is discourage you from attempting to buy your dream domestic. Financial attract tax deductions had been instated since the an incentive to track down borrowers purchasing land. This is accomplished by allowing you to deduct specific costs your incur regarding income tax year out of your nonexempt money. It is appealing to property owners who wish to greatest standing themselves economically by reducing the amount of money they must spend during the taxation.

How to Assess My Financial Tax Borrowing?

- You recorded an enthusiastic Irs setting 1040 and itemized your deductions

- The loan was a secured loans towards a qualified house you to you possess

Next, try to perform a little research on the entryway fields below so you’re able to estimate your own projected home loan attract taxation deduction.

- Home loan Number. This is basically the overall matter you grabbed aside to suit your mortgage mortgage.

- Mortgage Name in many years. Extremely home loans is actually issued on 15 or 31-season title durations.

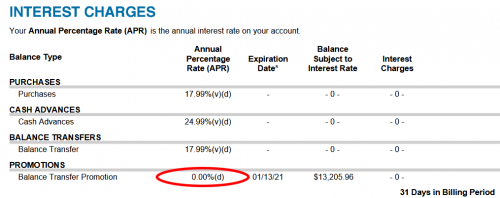

- Yearly Interest. The yearly appeal is dependent on in case the rates is restricted or changeable. Fixed rates are still unchanged on life of your loan. Changeable rates reset sporadically when you look at the alignment which have field change, that will bring about your own rate of interest to boost otherwise disappear.

- Government Income tax Rates. This is the limited federal taxation price you would expect to blow depending on your taxable earnings.

- County Tax Speed. This is the limited state tax speed you expect to pay.

- Monthly payment. Enter the scheduled monthly obligations because of it input. It will become principal, interest, or other charges which can be rolling into your complete mortgage payment.

- Interest Immediately following Taxes. This is actually the annual productive interest rate just after fees is actually taken into consideration. It is affected by mortgage obligations constraints.

Under 2021’s standard tax deduction, single tax-payers qualify for a great $12,500 deduction while you are married couples processing shared taxes be eligible for an excellent $twenty five,100 deduction. Keep in mind that itemized deductions are categorized as using your mortgage loan to shop for, build, or significantly improve your home. It is possible to be able to subtract attention for the a property equity loan otherwise line of credit (HELOC), as long as the loan was applied for example of those three aim.

This calculator takes on your itemized write-offs will exceed the high quality deduction to suit your tax processing reputation. If your itemized write-offs try not to go beyond your standard deduction, the benefit of deducting the attention on your home could well be shorter otherwise got rid of. Bear in mind if one makes increased income that enables for your itemized deductions is eliminated, their complete tax offers can be reduced.

Have there been Mortgage Notice Tax Deduction Restrictions?

Calculating their home loan attention tax deduction restriction can help you decide in the event the a standardized or itemized taxation deduction ‘s the best decision for your requirements economically. The brand new TCJA stipulates that there’s a limit exactly how far you could potentially subtract. As reported by Irs legislation, single-document taxpayers and you may married people processing mutual fees normally deduct family financial attract toward basic installment loans Richmond KS $750,000, otherwise, $375,000 while you are married but submitting by themselves.

To own people just who obtain indebtedness in advance of , the utmost financial desire income tax deduction is decided within $one million having single-file taxpayers and you can ount are faster to help you $500,000 while married but submitting individually. Deductions are also restricted for those who got aside a mortgage getting causes other than to invest in, create, otherwise alter your household.

Just how can The house Financing Specialist help?

An element of the Financial Expert’s commitment to taking homebuyers the best package it is possible to on their financing does mean which makes them familiar with income tax deductions they’re able to take advantage of to put by themselves greatest economically. A home loan attract tax calculator is an excellent starting place when estimating how much you might be capable subtract from your state and federal taxes this season. Talking-to one of the educated lending Positives is explain what qualifies due to the fact home financing tax deduction.

We out of friendly financing Experts is chosen throughout the same groups we serve. This will make united states always the clients’ means and ready to relate solely to what you’re going right on through once the homeowners. We all know when you are looking at coupons, all of the bit assists!

Very give us a call today during the 800-991-6494 to speak with a savvy financing Pros, who can help you determine how much you can save it taxation season that have home loan tax write-offs. We can also be achieved due to our app to ascertain if a mortgage income tax deduction is one of economically proper alternative to suit your private finances now.