Whenever you are currently underemployed, you won’t manage to make use of your jobless advantages to get home financing. not, there are lots of form of earnings you are able to purchasing property, and many of these may wonder you.

We will define what you need to get approved getting a home loan when you are underemployed, as well as have what you will have to reveal when you become gainfully operating once more.

Key Takeaways

- Unemployment earnings can not be used to get a property.

- Your debt-to-earnings (DTI) proportion is far more very important than simply earnings by yourself.

- You might qualify for home financing predicated on their offer letter regarding an employer.

- Regular and you will offer gurus you are going to meet the requirements to purchase a home.

To get a home If you are Out of work

Whilst you can’t buy a property having fun with jobless money, you can get a mortgage while you are underemployed. Considering Jason Gelios, a real estate agent at Neighborhood Solutions Realty regarding Detroit city, there are other types of income that will be noticed.

Income eg money dividends, Personal Safeguards earnings, and having an excellent co-signer or any other sort of income to arrive away from a non-traditional resource, are among the alternatives, Gelios informed The bill from the email address.

So just why won’t unemployment positives be considered? This money is perhaps not considered certified income to possess home loan borrowers since it is temporary, told me Jeff Gravelle, master development officer on NewRez, a home loan company located in Fort Arizona, Pennsylvania. To have a mortgage while underemployed, you would need to possess a minumum of one individual into application for the loan who is going to offer correct financial papers one to shows qualification, Gravelle advised The balance because of the email.

Debt-to-Income Ratio

After you go back in your feet and you will review the option of purchasing a home, it is very important score all of your current economic ducks in a row very first. You may need a reliable earnings record and you may a good credit score.

The debt-to-money, otherwise DTI, proportion is one of the most points loan providers imagine whenever determining whether to approve your financial application.

Understanding how to budget for enough time-title jobless can help you balance out your bank account ranging from jobs so you can keep the DTI ratio in check.

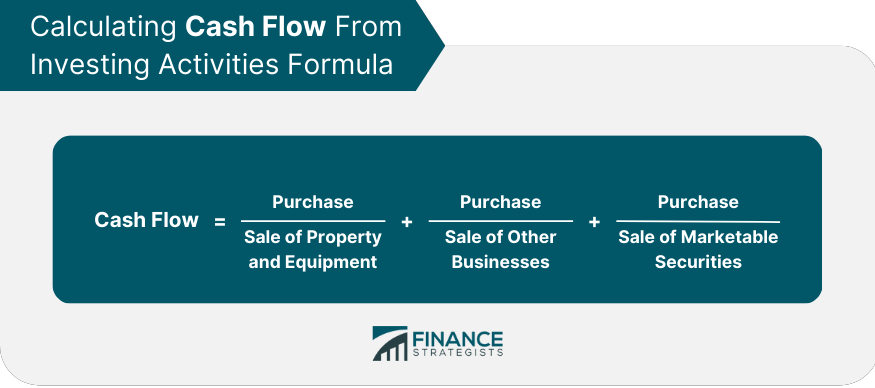

In order to calculate the DTI proportion, sound right all monthly costs, such as auto loans, handmade cards, and student education loans, upcoming separate which total matter by the terrible (or pre-tax) income. A beneficial 43% DTI proportion is usually the highest such as for example ratio one lenders usually take on.

A great guideline is the code, which means no more than twenty-eight% of your revenues would be utilized especially on the homes, and no over 36% is going to be useful any expense-and additionally casing.

Exactly what Qualifies since the Money?

So now you be aware that loan providers usually do not envision jobless advantages to become licensed money. Exactly what manage it envision? Loan providers get a hold of types of earnings out-of a job, capital returns paid down continuously, Social Defense checks, and other kind of regular money coming in, Gelios said.

So there are also other sorts of earnings that will qualify you. Alternative money present, including lawsuit settlement costs, alimony, and you can inheritance, along with number, Gravelle told you.

Once you’ve secure another occupations and you are back on your ft pursuing the a time period of unemployment, you have a better chance of securing financing. Your best bet for landing a normal home loan is to use when you have gone back to works and can let you know proof secure money, Gravelle said.

- Modern shell out stubs

- W-2 models

- Taxation statements

- Lender comments

- Money account statements

In the event that a debtor have any unemployment in the last couple of years, in fact it is handled once the a space, for the newest money are determined over the course of new past couple of years, Gelios said.

Be considered Centered on a deal Letter

Particular qualifiers exist because of it type of proof of earnings. Such as for instance Talladega loans places, the latest page might have to demonstrate that the fresh borrower might be working inside 90 days of having the loan, Gelios told you. It is going to need to show how much cash the money usually be and exactly how it would be given out; such, salaried otherwise hourly.

Regular Workers and you will Designers

If you find yourself a seasonal earnings earner otherwise company, Gelios told you make an effort to be considered based on the money you will be making regarding periods when you functions. Such as for instance, if someone else renders $forty five,000 in their performing seasons, which earnings might be determined over the past 1 year; if the zero earnings was acquired the year prior, after that you to definitely money will be determined more than 2 years.

Utilising the 24-day algorithm over, for those who gained $forty-five,000 a year, in writing, it would assist you to make $22,five-hundred per year.

Again, people income away from unemployment [about a few-year period] cannot be used within the being qualified to possess home financing, as loan providers examine whether the source of the new income try regular and just how good is the prospective away from coming income-even though upcoming earnings isnt calculated, Gelios said.

The new gig economy is growing, however these style of professionals may not will have the newest documentation necessary for old-fashioned loan providers. It might be worth every penny to own care about-employed borrowers to consider individual lending products, due to the fact personal loan providers do have more independence within their qualifying advice and you will may offer financial loans book to people who’re notice-employed, Gravelle said.