What consumers want to know

But not, the initial difference, the one component that will determine the new cost of one’s home loan, is how you intend to utilize the home loan. For a lot of, choosing the perfect around three-rooms where you can find live in are a priority. For other individuals, it is looking a sturdy investment property with an effective skeleton that they may lease.

You will find monetary positives and negatives to both choice particularly for very first-day homeowners. Lending getting home-based investment property sells a high exposure weighed against lending for manager-occupied services, and you can banking companies have to keep even more money because of it types of out of credit. Like any one thing, referring about what caters to the money you owe and wanted lifetime most useful.

The real difference: mortgage versus financing mortgage

There was a whole lot of difference between owner-filled homes (purchasing a home for you as well as your family relations to reside in) and you will investment qualities (to shop for a house you want to rent so you can tenants or flip to possess a profit). When applying for a home loan, you will need to identify if or not you prefer an owner-filled home loan or an investment mortgage. What you love to create will establish the latest generate-up of home loan.

Application requirements are very different

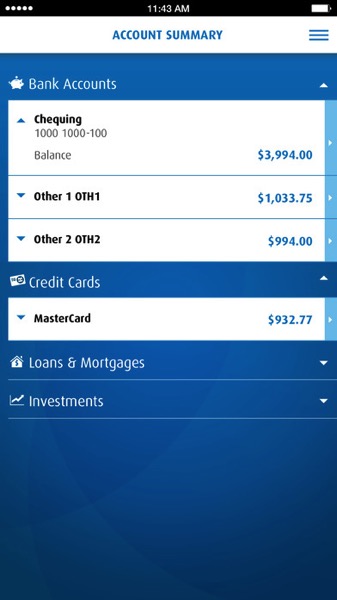

When you make an application for a home loan to buy a holder-filled assets, you’ll be required to likewise have a mix of the following pointers: your earnings and you will liabilities in addition to present obligations and discounts records. Loan providers tend to examine these anything facing a couple of criteria so you can see whether there is the financial capacity to services the meant financing.

To possess resource loans, certain requirements can be a little stronger, very a great offers records and you can exact facts of your monetary situations will be even more crucial. You will need to have demostrated you really have currency arranged to manage the mortgage even though you propose to sell the property quickly. If you fail to security the price of your mortgage payments along with your money, loan providers you’ll imagine potential rental earnings although this wouldn’t decrease your obligations-to-money ratio (an option factor in the loan approval procedure).

You will need to get submit a bigger deposit, especially if you currently very own and you will undertake a house. On top of all of that, loan providers get consider carefully your property’s possible escalation in worth over the years, along with styles regarding the housing market.

Your payments might look various other

For the capital financing particular lenders provide interest-simply money which can notably fall off how much you have to pay for every fortnight otherwise week. Interest-just money was rarely readily available when borrowing an owner-occupied mortgage by risk in it. Loan providers exactly who offer attract-merely payments will generally do it to possess a good pre-determined several months for this reason they might be top that have people who pick and you may flip features easily. At the conclusion of which name, your residence loan money revert so you can dominant and interest.

Taxation loans are very different

For many who individual an investment property which you book so you’re able to clients, you can claim a few of your residence expenses on the tax get back. Will set you back such as for example house insurance rates, pricing, resolve and maintenance, property government charge, and one notice charges obtain from the purchase of the house or property shall be subtracted. Should your can cost you sustained are to improve the property’s really worth, such cannot be deducted. For people who promote forget the within this five years of getting it, you may need to spend taxation toward one development you will be making throughout the selling. So it signal does not apply while selling most of your house.

not, understand that leasing costs was nonexempt. Together with, whenever or you want to remodel and sell your investment assets, your ount.

Rentvesting’ to own first-time homeowners

Family rates keeps risen exponentially in recent years, it is therefore more difficult to have basic-time homeowners to go into the house market inside their well-known suburb. Instead of to invest in property to reside, among choices has been to invest in assets since a rentvestor’ persisted to help you book, but to acquire a property so you can leasing out over anyone else. For the majority, this online payday loans Vermont might be a great way to obtain legs on the the house or property steps but get it done with caution and there is some restrictions. Such as for instance, you’ll not have the ability to drop into the KiwiSaver to fund their deposit, as you can simply withdraw KiwiSaver offers to invest in property to live in maybe not a residential property.

Get property, flip an investment usually query the experts

The method that you choose to use your residence commonly determine the kind away from financial you want. As a whole, possessions people might require a larger deposit, and there is more chance, however, flipping a home easily will pay large dividends when done really. If you are looking to acquire property that one can create a home, the program techniques could be much less difficult, but what you could borrow the comes down to exactly how savvy you’ve been together with your cash. All of the loan providers would like to know is whether you can easily fulfill the mortgage repayments.

To make certain you will get the proper types of financing while the finest cost for the finances, talk to the group at All over the world Loans today.