Secret takeaways

- An effective mortgagee condition is situated in of numerous assets insurance policies and you will will bring security to possess a home loan company in the event that a house try busted.

- If you are loan providers manage discovered defenses to your mortgagee condition, individuals work with as well out of reimbursements having solutions towards household including one reported forgotten property.

- Within the recognition techniques, the financial institution usually recommend that the insurance policy you decide on have to have the proper mortgagee clause (almost certainly noted on your commitment page).

Used in of numerous assets insurance rates, a beneficial mortgagee term brings cover getting a home loan company in the event that a great property is broken. In the event your house is damaged when you (the latest borrower) try paying down the borrowed funds, the insurance coverage company will pay their lending company because of it losses, even when its protected on the insurance coverage.

Mortgagee clause definition

Centered on Merriam-Webster, a great mortgagee clause is a clause for the an insurance coverage price one entitles a titled mortgagee as paid for destroy otherwise losings into possessions.

As well, according to Internationally Chance Government Institute, it kits you to definitely losses so you’re able to mortgaged home is payable towards mortgagee titled on the plan and you will promises improve written notice so you’re able to the latest mortgagee off policy termination.

With no safety of your own mortgagee clause, financial institutions was unlikely in order to loan the massive levels of currency necessary to pick domiciles.

Areas of a beneficial mortgagee condition

To provide protections you to definitely be certain that an income toward lender’s resource in case your house is broken or lost, numerous sections can be included in the mortgagee term:

ISAOA

New ISAOA, otherwise its successors and you may/or assigns runs the defenses provided because of the mortgagee clause to split up establishments if they decide to purchase the loan. This permits the financial institution to perform on additional home loan markets.

ATIMA

The newest ATIMA or as their passions may appear, is another preferred element of good mortgagee condition. So it part offers the insurance coverage policy’s publicity to virtually any associated people which old or destroyed.

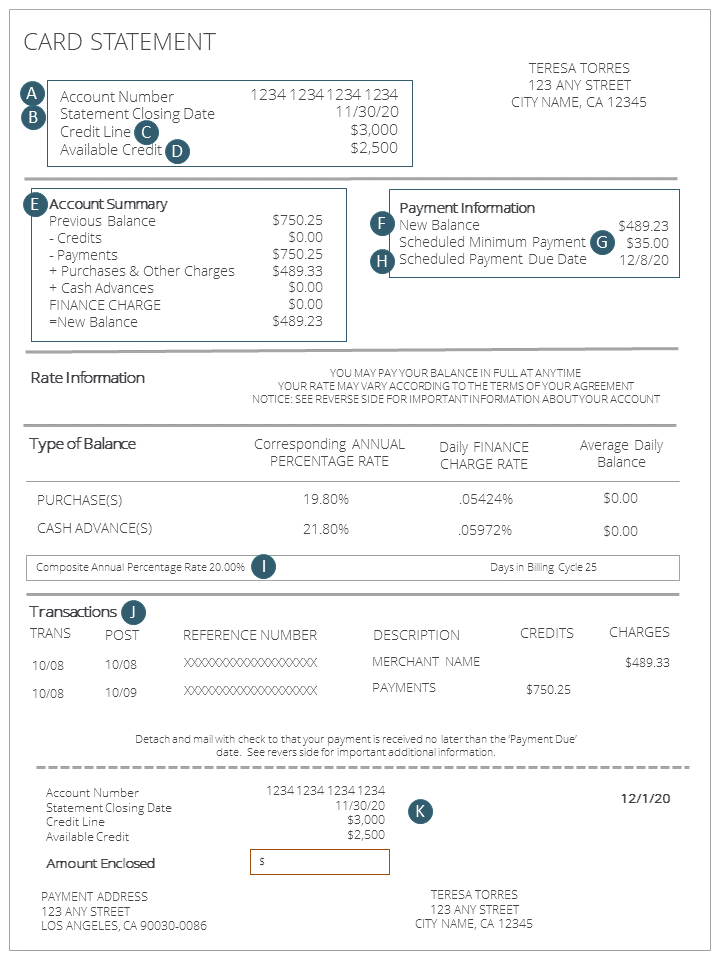

Losings Payee

A loss of profits payee ‘s the cluster that is eligible to the fresh insurance rates commission when the a declare is generated. Oftentimes, the loss payee plus the lender are identical. If a state are submitted, complete the loss payee section together with your home loan lender’s label, target, and you will mortgage count.

How come a mortgagee term performs?

In case of assets ruin, the brand new mortgagor works closely with their insurer to assess the damage, influence the new commission number, and complement repayments on mortgagee and the mortgagor.

New mortgagee clause states that the mortgagee (lender) is detailed due to the fact payee with the people insurance coverage repayments to guarantee the possessions might be recovered to help you its pre-broken condition.

If you decide to prevent to make insurance policies repayments or perhaps the policy try terminated, the loss payee is notified and you may given the substitute for push an alternative coverage that have a new provider. The price of the newest plan could be included in this new monthly home loan repayments.

Even if the mortgagors insurance possess lapsed because of skipped money, the new mortgagee can also be assemble to your insurance policy whenever they see this type of criteria:

- The fresh outstanding premiums is paid off

- An evidence of losses was submitted timely

- The latest insurance company are informed out of changes in the brand new property’s occupancy or control

While you are loan providers would receive protections to the mortgagee term, borrowers benefit also. This type of protections, built into insurance policies, somewhat remove dangers into lender whenever a home is actually funded, allowing consumers to try to get the cash that they must pay for their fantasy domestic.

Normally, homeowners’ insurance brings security into the borrower facing assets damage or death of individual house. If damage were to are present, which insurance coverage usually reimburse the newest citizen for fixes with the home in addition to people documented destroyed assets. As well, this coverage plus covers brand new homeowner away from legal debts would be to an effective loss or if an accident happens for the possessions.

How to get a great mortgagee term?

During the approval techniques, the lender will advise that the insurance policy you choose have to feel the proper mortgagee clause (most likely recorded on the relationship letter).

When you select your homeowner’s insurance provider, might supply the financial mortgagee term, such as the target of your bank.

To have a whole comprehension of a beneficial mortgagee term and just how it may apply at your unique financing, speak to your financing manager.