- Express on the LinkedIn

- Share by Email

Buying your dream domestic is not simple. It could be probably one of the most costly opportunities you can easily build in the websites your lifetime. There are plenty of facets you must consider just before paying for the primary that. It is vital to check and this university region, mall, and you may healthcare would be the nearest. However, before you even can indication the fresh documents, you really need to generate monetary decisions with the possessions.

Some lucky homebuyers have the opportunity to buy a home through a just about all-dollars deal. There are no loans or financing contingencies. The purchase arrangement document is really straightforward. Fee is accomplished because of cashier’s glance at or the import out-of fund. This is often over before or during the time of closure.

But do not overlook buying the domestic you have always wanted in the Dallas simply because you do not have enough finance. Almost every other alternates are readily available, eg crowdfunding, HELOC (house collateral line of credit), FHA 203K fund, and private currency loan providers. You to definitely solution that is wearing considerable appeal today was HMLs (hard money finance).

HMLs was funds the real deal home company financing objectives. He is good for investors who’ve knowledge of to shop for a good assets with the intent out of renovating they and you may selling they so you can create an instant earnings. Including loans bring higher rates.

Instead of most other mortgage loans, he’s tied to the worth of the property that is getting purchased. Since these financing keeps a relatively easy qualification procedure, consumers normally romantic swiftly. For most, it is adequate to validate the latest highest expenses associated with the fresh loan.

Hard money funds aren’t entirely bucks finance. In the event that a seller demands bucks-merely, they could maybe not agree to an enthusiastic HML. Bucks comes with the capability to make certain a virtually. There’s absolutely no exposure that resource often slip as a result of.

Which have a challenging money loan, there’s a probability of hiccups later on. As with any almost every other mortgage, they are subject to acceptance, assessment, assessment, etcetera. Some of these grounds might cause a software to-be refused during escrow.

However, there’s always place to possess settlement. And though not totally just like dollars, an HML might help settle a great deal. Centered on nerdwallet, the typical closing going back to buy and you may refinancing funds joint is from the 43 months. As the HMLs enjoys faster processing moments than just antique loans, it allow it to be men and women to respond to financial support opportunities easily. In most affairs, tough currency financing should be financed in this a week, states Retipster.

Very, in a manner, HML is regarded as just like the the same as cash. Hard currency loans and all sorts of-bucks offers try each other fast and versatile choice when purchasing real home.

Conventional present is getting a mortgage out of a community financial otherwise regional borrowing from the bank partnership

HMLs are fantastic capital products to have buyers. They are generally speaking expanded to people who possess experience in to invest in and you may promoting a home. Toward best plan, you’ve got a chance to build a good funds. Ideally, he’s good for:

- Solutions and you may flips

- Property advancements

In the two cases, difficult money loan providers may wish to look for the place you want to use the funds. They might also render suggestions about renovations that creates the essential go back to the worth of the house. Envision domestic home improvements which have the best Roi.

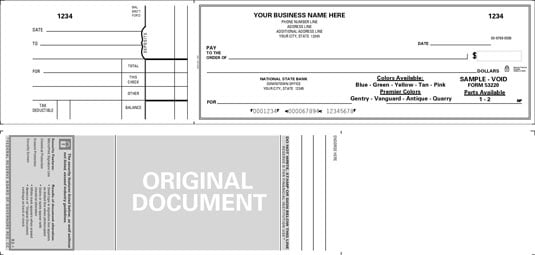

- Fund is actually easily acknowledged. There is smaller paperwork in it, therefore control moments are faster. The following files is called for:

- Your own conducted deal

- Your repair estimate

- The fresh new assessment

- Your own insurance rates binder

A lot of funds could be spent at once. If the borrowers borrow funds up against a life insurance coverage or equity on other functions, they still need to generate costs till the home is offered.

HMLs are not the same while the cash. However they bring a lot of a comparable lbs. This is your possible opportunity to maximize out from the flourishing real estate market. Be sure to provides a proper-thought-aside hop out strategy.