Very lenders also provide an excellent pre-requisite one defines minimal money this new borrower need to have so you’re able to be eligible for using the loan.

This may differ with countries. Certain financial institutions require the credit individual to own a full time income out-of Dh200,000 yearly getting Middle east places, as well as for Us or other nations: $80,000 per year.

Period tends to be minimal in comparison to owners during the Asia. Really loan providers also have an excellent pre-needed one describes the minimum income of your debtor.

Mortgage up against possessions interest are typically in the range of 8.7 per cent to percent per annum.

Therefore basic, verify that the borrowed funds rates of interest is actually lower in the country from quarters, and if sure, then you can be interested in taking financing around and you can following with the finance for the Asia, such as for instance settling otherwise refinancing your debt.

No matter if if that’s the scenario, you’d also need to cause for the expenses inside, including the exchange rate, handling will set you back and you may foreclosure will cost you, which we’ll proceed through in more detail next when considering dangers so you can refinancing.

Dangers to refinancing

Be it with respect to borrowing facing loans-100 % free land otherwise refinancing funds till the loan’s name several months concludes, all of the different refinancing has the risk of additional fees or charges.

quick cash loans Essex Village

Oftentimes, finance companies fees all in all, 1 % of your own loan count approved otherwise INR10,000 (Dh485), any kind of try highest, as processing payment.

Particular lenders can charge 2 percent once the prepayment charge. Assuming recently fee of one’s equated month-to-month instalment (EMI), your p obligations is applicable as per county statutes.

One of the major dangers of refinancing your residence arises from it is possible to penalties you are able to happen down to settling your financial with your collection of domestic security borrowing from the bank.

For the majority mortgage preparations you will find a provision which allows the banks to help you cost you a fee for doing so, that fees is amount go into the plenty.

Since an NRI, this type of costs are priced between buying an attorney to be certain your are receiving the most beneficial price you are able to and you will handle paperwork you may well not feel safe or not in a position to filling aside, and bank charges.

Versus amount of money you’re bringing out of your credit line, however, preserving plenty in the end is always worth taking into consideration.

The process of refinancing also can entail additional charges eg house mortgage operating payment, which one should be considered especially when researching advantages of one’s transfer out-of mortgage from 1 to another.

In this instance, as documents try authorized by the this new facilities, a beneficial cheque of your the amount treated into the fresh new financial was given so you’re able to foreclose the borrowed funds.

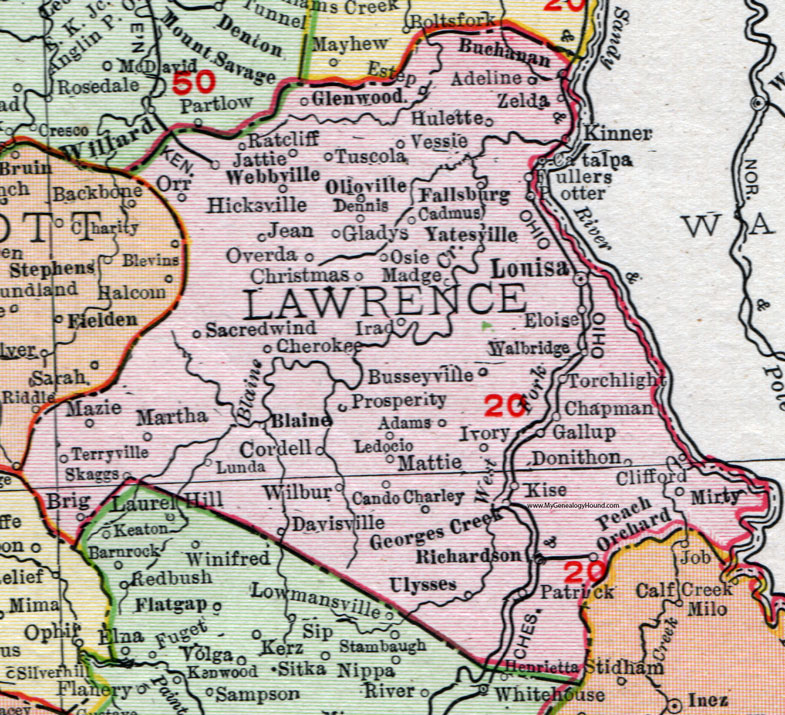

Much more finance companies throughout the UAE have to offer product sales on the present mortgages, in which it slow down the interest rate billed to own a one-year period, passageway on the current cut in interest levels to the people. The picture is employed to own illustrative motives merely. Visualize Borrowing: Given

Given that you will find find out the some other facts refinancing can be used let’s today find, ways to go about it.

Examining your eligibility

Now visiting an option criteria, which is checking whether you’re qualified. Extremely refinance place will likely be just be availed in the event the certain criteria is fulfilled.

First and foremost, what is requested of the extremely financial institutions would be the fact minimum level of EMIs (or the if you find yourself refinancing facing a debt-totally free household) being paid off of the consumer. Subsequently, the house or property is preparing to take or currently filled.