Top-level AVMs is guess the worth of a property (inside a good blind buy transaction) within ten% regarding 80% so you’re able to ninety% of time. Would it not amaze you to know that greatest-tier AVMs is also worthy of regarding 100,000 features hourly? Why must you see other device for this function? Particular lenders play with indices of house rate like to decide latest value/equity because they’re inexpensive. This might be a false economy because these tools are not within the the same group since the best-level AVMs when it comes to valuation precision within possessions level.

With determined the degree of household collateral, then the smart lender marketer do begin to part financing offers according to the class of the house holder. If your lender does not understand demographics of your homeowner, there are numerous research companies that be a little more than just able to during the this. When that occurs, the lending company usually takes the credit produce domiciles and employ AVM analysis so you’re able to quickly find out its security status. After that, contact one to domestic to find out if your own enterprise may help all of them having a potential new financing.

Everybody knows in the real estate sites that give a general valuation estimate. Perhaps the really worth considering is useful otherwise crappy, customers enjoys a fascination with this technology. It may otherwise might not surprise you to definitely remember that the current top-tier AVMs on bank marketplace are a good price significantly more right than just such 100 % free websites since they’re most readily useful examined, as well as have all the way down suggest and you will median pure errors.

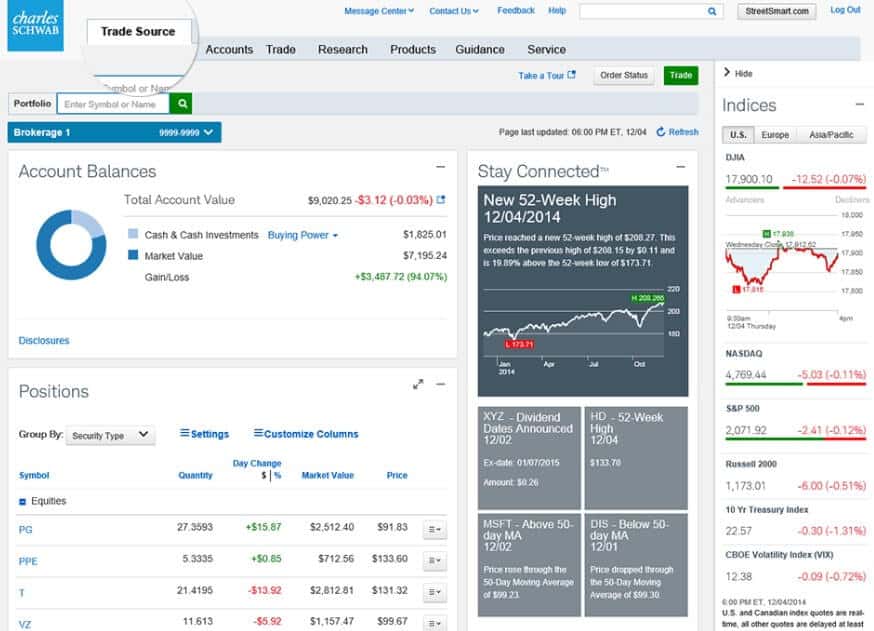

We suggest that lenders put property valuation (AVM) technologies off an old AVM provider on the webpages exactly as a few of the biggest lenders have done. Using this electric, you will understand in the event the clients are in the market for a good refinance or purchase. Specifically, the newest functions are cherished is going to be sent back again to the lender and you may called a customers (a home) or non-customer (a home).

Similar to this, loan providers can turn just what may seem like a consumer recommendations electric with the a lead producing host. When the a lender isnt having fun with AVMs as part of its a house prospecting jobs, you happen to be lost a significant feature that may make deals services more efficient.

Understanding when and ways to explore an AVM substitute for support future sale and you can include base lines is in the best interest of everybody active in the origination process. Companies must make sure that the valuation systems used was producing the quintessential perfect well worth possible. And you may, in today’s environment from tight index and you can strict borrowing from the bank boxes, AVMs is actually a vital mixture for success.

$ten,000 lowest loan amount and you will $500 minimal see. Loans $250,000 otherwise quicker want push-because of the appraisal, financing $250,001 $500,000 wanted complete appraisal. Money $ or maybe more wanted complete assessment, closure which have Attorneys which have Identity Insurance coverage paid down by the borrower (excite get in touch with Lending Dept. for cost of appraisal). 1-cuatro members of the family manager filled services only. $ annual fee reduced with the cashadvanceamerica.net tax refund emergency loan anniversary waived having automobile shell out from Ion Bank checking account.

Looking to bogglehead view: must i wait 30+ months next pay for a bona fide assessment or move on to an alternative HELOC supplier?

Family Collateral/2nd Home loan Appraisal Statement

- Financing quantity from $10,000 to $five-hundred,000*

- Fund was susceptible to the very least monthly payment away from $.

What’s an appraisal? An assessment correctly analyzes the value of your home in order to reflect their field-well worth well worth. He’s did of the a third-group, perhaps not your own home loan company, to be certain there’s absolutely no bias and also the worth of your house returns accurately. Appraisals are important in order to people, sellers, and loan providers to make sure property are listed fairly and you will consumers is given an accurate market price.

College Study

You are going to need to remark this new appraisal guidance in which they talks about the utilization and you may confirmation off AVMs. Listed here is one site about recommendations.

I am a bona fide home appraiser incase you have questions go ahead and PM myself and you can I will address once i possess date.

You truly will not have much say in how the lending company verifies the fresh new property’s well worth, it will not damage to inquire about.

The rise for the HELOCs produces a window of opportunity for lenders to consistently suffice its borrower, but inaddition it produces a problem. Lenders face purchases pressures due to the large price of a good traditional assessment since the broadening appraiser shortage will continue to prolong appraisal turnaround minutes. HELOCs are often provided during the little rates towards individual and you may, there isn’t any actual certainty your homeowner will in fact tap with the loan and construct outstanding balances for the financial. Ergo, its vital the bank originate the product on low you are able to prices when you’re subject to wise borrowing chance.

Users that have considerable amounts from domestic security have many selection. Capable offer the present where you can find change-up otherwise exchange-down. They’re able to will also get a house improvement or security financing rather effortlessly. Either way, equity try king, while the visibility out-of equity provides the consumer enough shelter-associated solutions. Quoting the level of home security in a given possessions has not ever been easier. AVM rates and precision provides enhanced significantly in earlier times few years.