Incorporate Lenders, a mortgage lender, now offers a variety of loan alternatives for home purchase or refinancing. Their attributes cater to an over-all spectrum of borrowers, of basic-go out homeowners to knowledgeable investors. This article undertakes the task away from bringing a keen thorough writeup on Accept Domestic Loans’ financial issues, dissecting its app process, analyzing rates, and gauging buyers feel.

Mortgage Products and Terms and conditions

Incorporate Lenders suits borrowers’ varied demands by offering a beneficial quantity of financial circumstances. Of these with solid credit and you can secure earnings, they give you an amazing choice courtesy old-fashioned finance; meanwhile, FHA finance establish possibilities to own individuals who’ve all the way down credit ratings otherwise tends to make quicker down costs. Specifically designed getting veterans and active-duty services people is actually Va fund. These types of provide favorable words and want zero down payment. Outlying homebuyers discover USDA loans appropriate the help of its provision off 100% investment and flexible qualifications conditions. Incorporate Home loans expands jumbo financing choices for borrowers planning to money large-well worth characteristics one go beyond conventional loan limits.

Borrowers, inside their said out-of loan conditions, can get it done the flexibleness to pick ranging from repaired-price and you may variable-rates mortgages (ARMs). They may favor stability and you will safeguards given by a predetermined-speed loan you to definitely promises consistent monthly obligations throughout the its lifetime. Alternatively, to market otherwise refinance before every interest rate adjustments exists, borrowers might find Palms more attractive with regards to generally down initial prices. Borrowers need to learn the latest subtleties of every financing equipment and you can name so you can line-up its decisions through its monetary desires. That it knowledge is crucial.

- Consideration: Borrowers is always to meticulously see their financial situation and you will much time-name homeownership plans before choosing a loan tool.

- Fact: Incorporate Family Loans’ many mortgage possibilities advances the likelihood of finding a suitable financial services to possess diverse debtor profiles.

Application Procedure

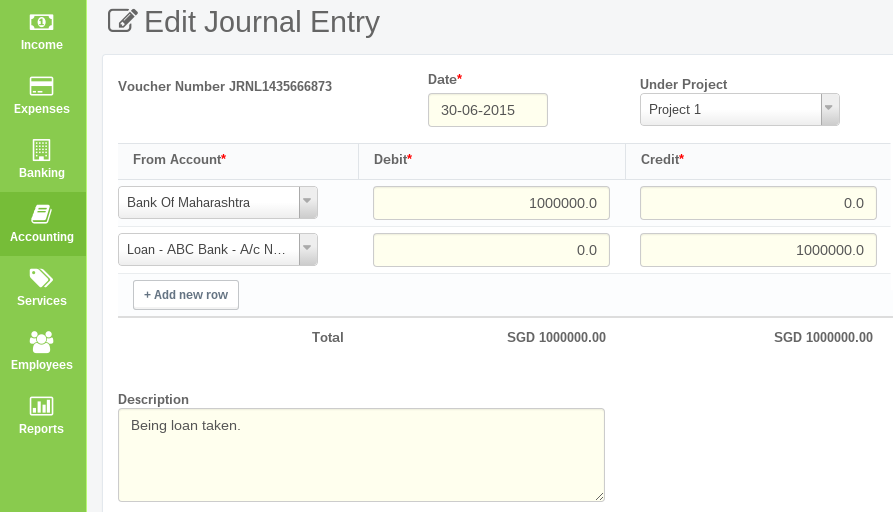

The program processes that have Accept Mortgage brokers prioritizes simplicity and you will use of to have consumers. Whether or not implementing online otherwise thanks to that loan administrator, the procedure begins with event the necessary documents, and proof of money, a position record, and you will asset verification. Embrace’s online program now offers a convenient method to have submission files and tracking application advances in real time. Also, individuals will benefit out of personalized assistance and you may advice of loyal mortgage officers throughout the entire process, guaranteeing a smooth and you can productive sense.

After distribution the original software, borrowers read total underwriting to evaluate creditworthiness and you may loan qualification. This involves a comprehensive comment and confirmation from economic recommendations, work status, and you may assets assessment. Embrace Home loans will facilitate the fresh approval processes while keeping rigorous conditions to have in charge lending. Clear communication channels having mortgage officers permit borrowers to deal with one inquiries or questions punctually, cultivating openness and you may count on regarding home loan travel.

- Caution: Consumers would be to guarantee the punctual submitting from needed records to avoid delays in the app procedure.

- Noteworthy: Embrace Home Loans’ emphasis on custom assistance distinguishes it as a borrower-centric financial purchased powering anybody from the complexities out-of protecting a home loan.

Rates and you will Fees

Whenever individuals check home loan choices having Incorporate Home loans, they must critically consider rates. Numerous affairs, prevalent business criteria, the borrower’s credit history, and also the selected loan variety of, bring about these prices to vary. For funds-mindful consumers seeking balance in their mortgage identity, fixed-price mortgage loans offering uniform rates of interest render reassurance. Instead, very first, adjustable-speed mortgage loans (ARMs) introduce straight down interest rates. not, these could sometimes to switch responding to offer motion, a potential impact on monthly premiums.

Consumers securing home financing with Incorporate Mortgage brokers will be actively think associated costs, along with interest levels. New origination commission, within the administrative can cost you off running the mortgage app, can be fluctuate predicated on exchange complexity: an important factor to keep in mind. title loans in NH During closing, certain expenses called settlement costs are generally owed. These are typically but are not restricted so you can appraisal fees, term insurance rates, and you may attorney charges. Additionally, individuals need to take a look at the the possibility of prepayment charges. This type of fees would-be levied should they accept its mortgage prior to brand new specified title, a feature worthwhile considering.