As per the Va Assistance for Deferred Student loans, Virtual assistant money are known for as the very flexible certainly most of the mortgage programs. Mortgage lenders factor in student loan loans whenever determining borrowers’ financial obligation-to-income ratios. Do you offer information regarding exactly what deferred student loans incorporate?

Deferred Figuratively speaking towards the Va Financing

For every the new Va Recommendations on Deferred Student loans, deferred student loans try student loan repayments that the loan provider has actually temporarily defer. It is required to understand that deferment will not translate so you can forgiveness. Consumers aren’t necessary to make the lowest monthly installments during the brand new appointed several months. Still, it is very important to identify that figuratively speaking, especially when racking up ample amounts, can be somewhat affect your degree for a mortgage loan.

This really is specifically associated for individuals that have state-of-the-art grade, including scholar or elite group amounts. Pros such physicians, dentists, and you may lawyers often have education loan costs exceeding $100,000. Whenever figuring a good borrower’s personal debt-to-money rates getting a mortgage, multiple real estate loan software need offered deferred education loan loans.

Fannie mae and you will Freddie Mac computer Education loan Guidance

Previously, Old-fashioned Loans necessary the newest incorporation of money pertaining to education loan debt, also those in deferment, when choosing borrowers’ financial obligation-to-income ratios. not, previous news to your direction has caused alterations in this strategy.

For each and every new recommendations, people deferred student education loans, regardless of their deferral months surpassing 1 year, must be taken into account DTI data to possess authorities and you may old-fashioned mortgage applications. The above rule doesn’t affect Va money because they realize certain guidelines to the deferred college loans. In the event that an excellent Va financing applicant has actually deferred student loans, the lending company need to review this new Va guidelines to choose just how to assess the fresh new DTI ratio.

Federal national mortgage association And Freddie Mac Student loan Recommendations

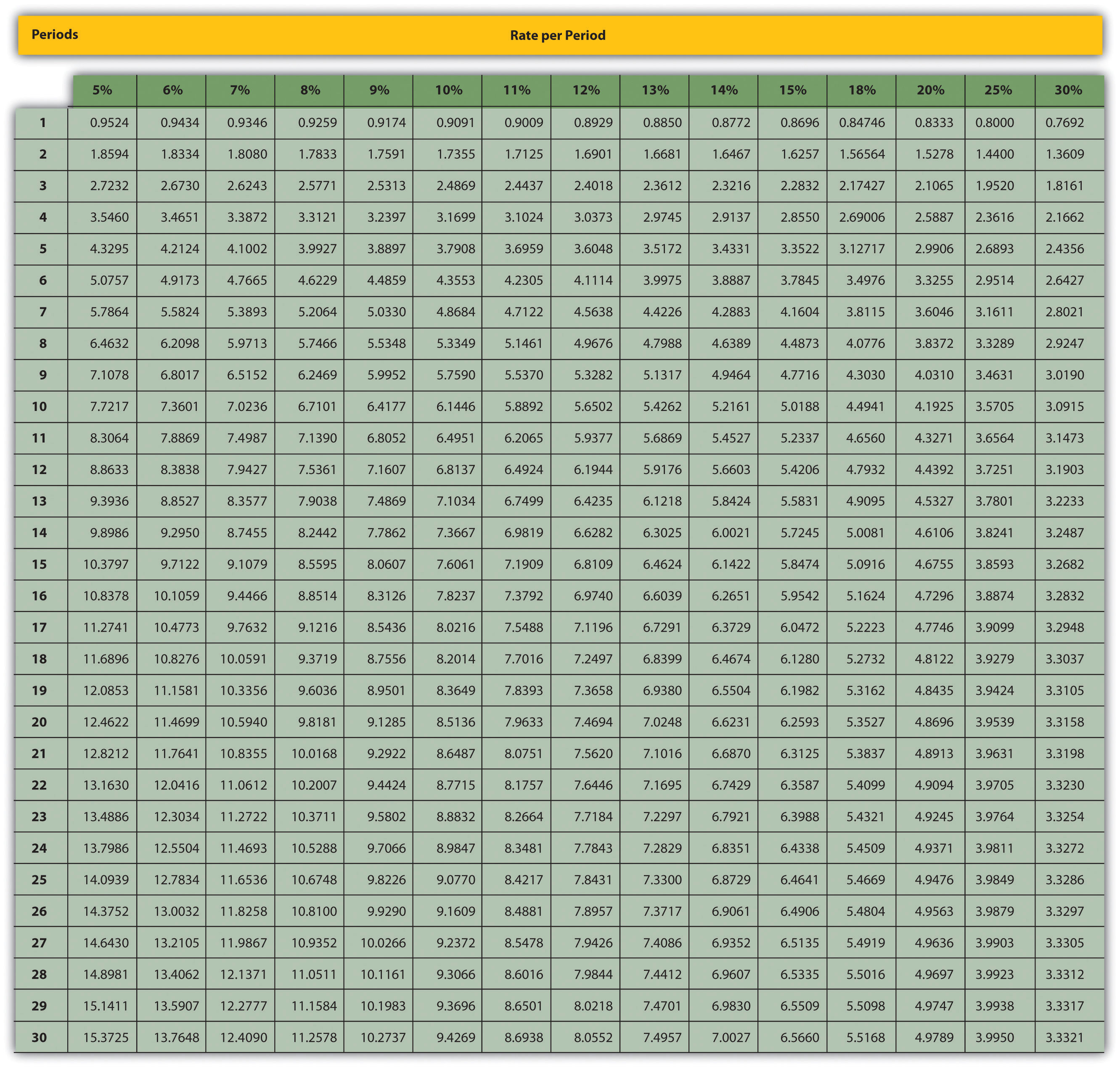

Fannie mae and you can Freddie Mac, the main influencers inside the setting-up direction having Antique home loan financing, mandate one to 0.5% of your own deferred education loan equilibrium need to be noticed a monthly debt. An option strategy was communicating with the fresh education loan supplier and you may obtaining the completely amortized monthly payment count according to a lengthy percentage plan, normally comprising twenty five years, predicated on Va Guidance on Deferred Student education loans.

IBR Money Now Acceptance For the FHA and you will Conventional Finance

FHA and Conventional financing has adapted to accept Earnings-Based Payment (IBR) Repayments, provided they are duly claimed to your credit bureaus. Considerable student loan debts can potentially hinder financial acceptance for borrower. Individuals for the fields such as for example drug, dentistry, training, or legislation, usually possessing reasonable college student financial obligation due to advanced amounts, commonly run into pressures inside the appointment the newest certification to possess mortgage loans.

FHA Guidance With the Deferred Student loans

FHA Recommendations Towards the Deferred Figuratively speaking used to excused deferred scholar money that have been deferred by the at the very least several or more months. However, not as much as HUD 4000.1 FHA Manual which had been revealed for the , deferred figuratively speaking that happen to be deferred to have several or more days are no lengthened exempt regarding the FHA financial borrower’s financial obligation in order to income proportion data. Not as much as HUD 4000.1 FHA Guide, FHA individuals that have deferred funds away from a dozen or even more weeks was no further excused.

The new Hypothetical https://paydayloanalabama.com/redland/ Personal debt Placed on Deferred Student education loans

They have to see a payment per month plan about education loan vendor which takes care of the entire loan amount more a lengthier duration. This plan is to obviously state the amount to be paid month-to-month. If the individuals cannot give it amortized monthly payment, the lender tend to assess the new commission while the 0.50% of your total a good education loan financial obligation balance.

Virtual assistant Recommendations To your Deferred College loans

This new Va Direction For the Deferred Figuratively speaking are significantly more versatile than other regulators and you may antique financing applications. Among home loan software, Virtual assistant Financing distinctively ban deferred figuratively speaking of Personal debt-to-Income (DTI) Data. It is important to remember that for this exception to utilize, student education loans have to have been deferred having a minimum of a dozen months. Experts borrowers with deferred student loans benefit from the advantageous asset of perhaps not factoring this type of funds towards obligations-to-income ratio data.