A property collateral financing is a kind of protected mortgage in which a borrower uses the new collateral of their domestic as the equity having the financial institution. The amount readily available can be influenced by the value of the latest possessions since the determined by a keen appraiser about bank. Getting one ones loans means your house possess a beneficial lien on it and your real security yourself is faster. Credit from the guarantee of your house are going to be an excellent method of getting a decreased-costs loan. There’s two version of home guarantee fund: family security lines of credit (HELOCs) and you may repaired-rates financing. Each of these keeps their positives and negatives, so make sure you opt for the one that is most useful aimed that have your needs. Whenever you want specific give-on the recommendations, consider hiring the help of a dependable monetary advisor.

Home Security Fund Definition

Property equity loan, possibly also known as an excellent second mortgage, even offers a method for people to help you use in line with the guarantee they hold in their residence. Quite simply, you could potentially borrow money according to the difference in the current equilibrium of your own financial as well as your residence’s latest worth. The latest collateral you hold in your home is short for the guarantee.

- Household equity line of credit (HELOC): A good HELOC allows people borrow funds as they you want. These are always adjustable-rates fund, even so they carry a particular title length. Because label is finished, you should repay just what you have borrowed.

- Fixed-speed home collateral mortgage: Like a fundamental home loan, this fixed-rate mortgage will provide you with an individual lump sum payment. As its label ways, you will need to build typical repayments within a flat interest getting a certain term.

Household Security Mortgage and HELOC Benefits

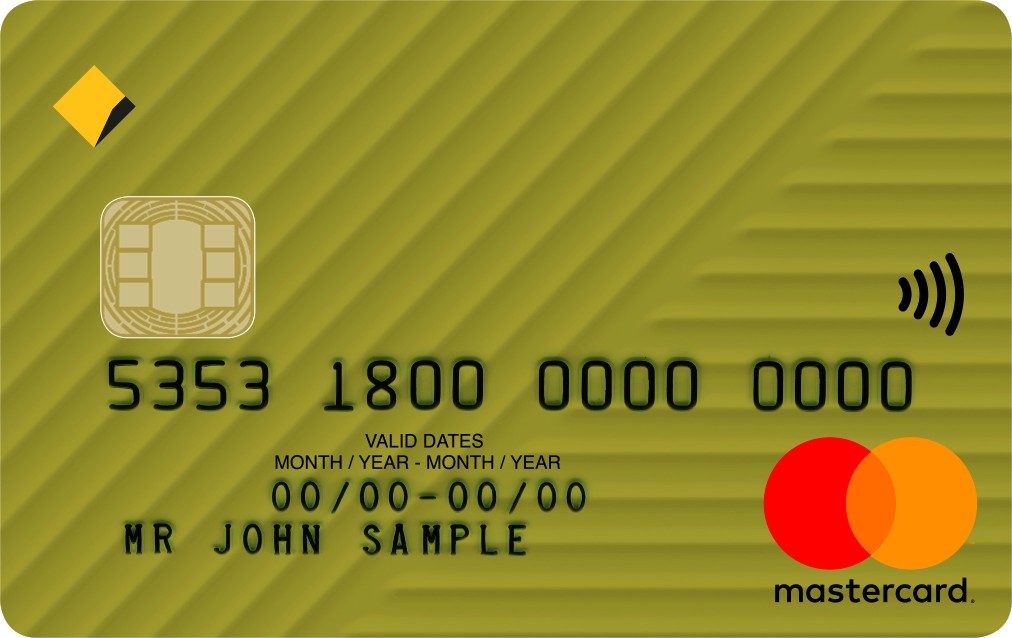

As opposed to unsecured loans (for example a personal bank loan) otherwise credit lines (such as for instance a charge card), you plan to use your house because the equity. This might be real away from one another a home collateral loan and you can an effective HELOC. This means it will be far easier so you payday loans Palmer Lake can qualify for your loan offered your kept home loan really worth is less than your own house’s value.

Moreover, house guarantee money enjoys fairly lax criteria. Family guarantee fund will call for brand new homeowner getting in the least fifteen% security in their house. As much as credit scores are concerned, a rating with a minimum of 620 is commonly sufficient to possess acceptance. The debt-to-earnings (DTI) proportion should not be any over 50%.

You’ll also rating straight down interest levels with a property collateral mortgage than just other equivalent options. According to ValuePenguin’s 2019 declaration, the average speed toward fifteen-year repaired-rates home security financing was 5.76%. To own an effective HELOC, its 5.51%. Keep in mind good HELOC generally offers an adjustable speed, definition the interest rate can transform once the markets pricing move.

Past that it, domestic guarantee money usually enable you to obtain a substantial amount of money. In reality, they’re able to assortment from $10,one hundred thousand doing thousands of cash. You are able to use them for just about any objective. Consumers are able to use the cash to possess domestic home improvements, paying down highest-notice fund, investing in school and you will carrying out a corporate.

That have a home equity mortgage, how much cash you might use try specific and place in stone. But if you prefer a beneficial HELOC, you will have alot more independence. It is because you could potentially pull out around your need, when it’s needed, up to brand new maximum of one’s HELOC. Your payments vary also.

Domestic Guarantee Mortgage and HELOC Drawbacks

The top risk with a home guarantee loan or HELOC is actually that you could cure your property if not pay they right back. The purpose of a protected mortgage, anyway, is the fact loan providers be much more ready to provide for you because the they are aware they’re able to take your equity if you don’t spend. In this case, the new collateral will be your household. Dont risk the newest roof more the head to own a minimal-pricing loan for those who have a doubt regarding the ability to repay it.