If you find yourself unsure in the which form of earnings calculation is suitable best for your position, you might want to believe inquiring an agent you to specialises during the mortgages getting notice-operating individuals payday loan Salt Creek look at the money, look at your qualifications and recommend a listing of appropriate options.

We’ve got assisted hundreds of anybody pick a mortgage immediately following they’ve tried to look for by themselves. One of the most preferred facts we come across are a beneficial self-working debtor deciding on an unimportant lender that simply cannot accept the new financial amount they want. An instant chat with us always resolves this.

Improving the probability of borrowing much more

If your notice due to the fact a debtor is ideal, a lot more loan providers will be open to acknowledging your once the a consumer. There are several effortless things you can do to improve your value and you can meet the requirements out-of a wide list of financial institutions and you can loan providers, like:

Conserve more substantial put – the higher your put, the reduced your loan-to-worthy of ratio. Having a top deposit makes you look committed to the latest mortgage as you provides more substantial upfront risk on property worthy of.

Promote property because the coverage towards loan – some loan providers have a tendency to think about the property value property instance since the assets, luxury trucks otherwise precious jewelry to offset the risk of a much bigger mortgage.

Alter your credit file – not one but toward all the other sites you to screen credit history given that each one of these may have a new checklist regarding your levels, costs and you may credit score. In the event that you can find one a great costs, plan to expend them from or if perhaps affordable, obvious all of them. Ensure that your address and facts was correct and appeal any outdated information regarding debts towards the amazing loan providers.

Query a family member that is a homeowner so you can counterbalance the home loan – They might utilize the property value their residence given that cover getting the mortgage, letting you use so much more.

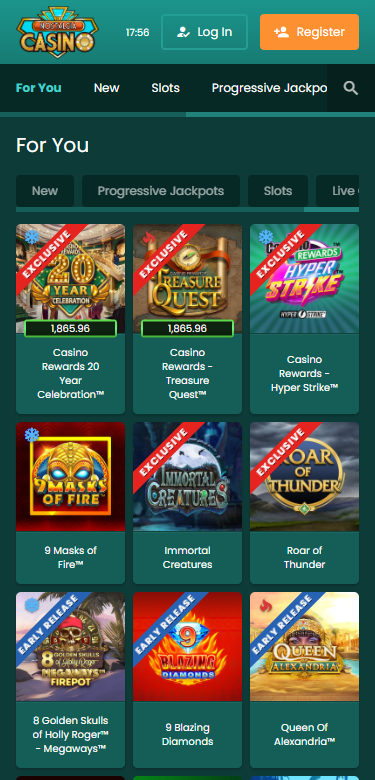

Change your money management – Avoid playing websites for instance the Federal Lotto, PaddyPower and you may 21Casino. Perhaps the odd flutter enables you to appear to be a dangerous and you can impulsive spender and lenders won’t want it. Stop payday loans and maximising their overdraft including the plague as well.

Do i need to get rid of my business expenses thus i is also obtain alot more?

We have expected all of this the full time. You’ll be able to obviously have enough providers expenses because a home-functioning staff, whether or not one to function as price of a notebook, devices, outfits or getting clients away having coffees to discuss after that projects.

Usually, you should were such can cost you inside your expenses on your tax returns however, doing this reduces your total cash. Although this will reduce the degree of taxation you have to pay, the cash is what most loan providers will look during the to help you assess the restriction home loan number. Faster profit = faster mortgage loan and that causes you things if it concerns buying the possessions you desire.

Talk to a separate financial advisor about any of it, and additionally a mortgage broker. Between the two, they could guide you into the having the proper harmony ranging from offsetting your company costs facing funds and obtaining the level of home loan you need.

Self-operating financial guidance

Dealing with your home loan research by yourself is not necessarily the best way so you can get the best offer or borrow to need. Instead of advice on whom to help you method, could cause signing up to a loan provider which have requirements you do not see hence causes a getting rejected many times.

Telephone call 02380 980304 or pop music your own term and you will current email address towards the contact form if you’d prefer to chat afterwards. When the phone calls commonly your thing and you may you might love to content, use WhatsApp to find the important information easily.

Constantly, banks look at the yearly income along with returns in fact it is of use if you’ve paid down on your own a little money to have income tax purposes. There are also lenders which can capture your retirement benefits just before tax into account too and a small gang of loan providers will also assess the utmost borrowing number because of the also a portion out of chose earnings.