And so i commonly imagine your own collect spend is about $4500 (without having any in your free time business). If you had few other repayments you might probably be eligible for a mortgage away from 300K if you had 50K to get off into the a 30 season mortgage. Obviously this would be quicker dependent on your payments.

By using credit cards to possess benefits and you may pay it regarding per month, some loan providers may count so it into the your debt-to-income ratio.

You might not want it normally home since you are able as it may limitation one most other business opportunities, such as for example capitalizing on the 401K match at the manager.

BTW, whether or not it was me, by the tomorrow I might have 1K inside the an emergency finance, zero student loan, and you will a great 37K car loan. Together with I would imagine that i are three years, roughly, off to find a house. Since the as well as repaying my unsecured debt and you may protecting to own good downpayment, I would personally would also like to have a crisis financing.

Justin Cavern features an effective address and you will Pete B.is why is actually pretty good, but there’s a bit more to that one to has not been told you yet.

Because the Justin Cave mentioned, there are numerous financial hand calculators nowadays that will make it easier to determine a few of the sheer mathematics of the financial, but that is only skimming the exterior out of just what you’ll need to discover the method, thus i would not get into one.

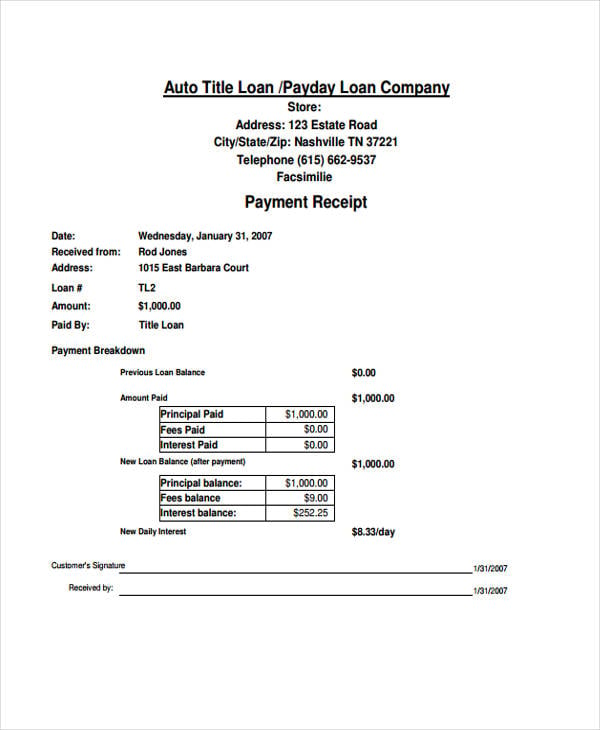

Auto loan

Pete suggests to finish the brand new college loans and you will pay of a bit of the auto mortgage. The difficulty thereupon was student loans are thought really in a different way for the credit than many other loans. Auto loans is actually protected loans, up to they’re not. If you get in a car destroy and it’s totaled, their insurance pays particular (if you’re not at fault), however, likely not totally all, of loan. The remaining loans becomes unsecured, therefore it is wii type of personal debt to possess when thinking about a home loan. Mortgage lenders learn this, and will handle it accordingly.

College loans commonly secure personal debt in addition they are not unsecured debt. For example scientific debts, he or she is inside the a class by themselves. They connect with the borrowing quicker, bad and the good, so are a far greater issue getting than many other loans. Miss two payments on your own vehicle, as well as your borrowing is drop substantially. Miss one or two repayments in your education loan and your student loan business has many, legally outlined an easy way to aid you to keep you from banging oneself and also for the education loan business of fucking your. Most other financing don’t possess these defenses installment long rerm loans no credit check Augusta MO. And your borrowing is not as substantially impacted.

I would personally strongly recommend repaying the vehicle before you can pay off your student loans. I would along with suggest remaining about half a year of one’s once-financial costs to own an urgent situation financing. Since the a through-the-cuff count, I might highly recommend shedding $20k of savings on your car loan, while maintaining the rest to suit your emergency funds.

Handmade cards

You do not speak about credit debt, but I’m going to guess you have some. That is needless to say consumer debt, thus pay you to definitely away from before settling the vehicle.

And searching finest on the mortgage app, credit card debt might have a serious negative influence on your own credit score. Eliminating they prevents delivering hit multiple times on the application getting personal debt. Yes, it is far from supposed to connect with you several times, however it does. It impacts your credit rating, your debt to help you earnings proportion, and having an abundance of credit card debt helps it be feel like you are ready to always boost your credit debt past what is economically easy for you. Mortgage brokers will say to you they won’t envision like this, however they would although it is unconsciously. This may additionally be element of its providers plan.