Rates have been ascending previously year or so – into the handmade cards, mortgages, and other borrowing products such family security financing and you may domestic equity personal lines of credit .

Still, that doesn’t mean these items are always bad details right now. Indeed, for the majority of property owners, taking out a house security financing these days could actually feel a sensible disperse.

Is it a good time to take out a home security financing? Positives weighin

This is what gurus need to say throughout the whether this is basically the correct time to take out a home equity mortgage.

Yes… as the house equity have likely maxed away

« If you have owned your property for most decades and its particular really worth has grown because your buy, you likely have oriented-right up equity, » states Hazel Secco, chairman away from Fall into line Economic Choices during the Hoboken, N.J. « So it enhanced household value brings a good foundation to have securing a beneficial house equity loan. »

Nevertheless, you to definitely huge chunk away from security may not last for much time. With a high mortgage cost pushing down buyer demand, home values – and, by the extension, domestic security – could slip, as well. It indicates you would should act in the near future when planning on taking advantage of your equity from the the maximum.

« For somebody looking to faucet household collateral, now’s a very good time to seem engrossed, because home prices may not rating much better towards the near future, » states Michael Micheletti, master marketing manager in the home security trader Unlock.

Household collateral funds are not best in the event the you’ll need to sell the house in the near future, as if your residence drops inside well worth ranging from once in a while, it may « produce a posture also known as being under water, » Secco states, « the spot where the a good financial equilibrium exceeds the fresh home’s economy well worth. »

When you find yourself under water on the financial, offering your home would not internet your enough to pay your finance, and you’ll end up due their mortgage brokers towards the remaining outstanding stability.

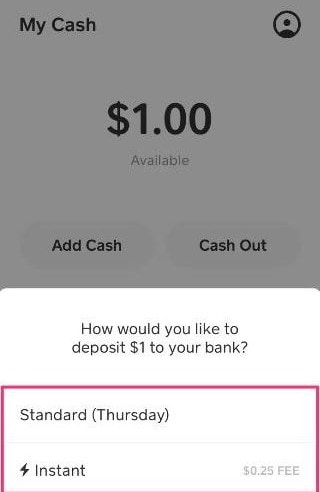

In the event that all you have to pay having – family repairs, medical costs, or any other debts – are inevitable and you may create otherwise go on a credit card, consumer loan, or any other style of highest-attract financial obligation, a house guarantee loan could be a much better selection. Once the Secco places it, « Almost every other loan rates aren’t really appealing at this time. »

The woman is proper: The typical bank card price is more than 21% nowadays, compared to the 8 in order to 10% you’ll find on the a property collateral loan. Personal bank loan prices keeps topped several%.

« It is the much more economically beneficial solutions versus taking right out an excellent personal loan otherwise counting on credit card borrowing from the bank, » Secco says.

Zero… when your credit’s maybe not higher

Like with most borrowing products, your credit rating takes on a huge role inside the besides being qualified to have a property guarantee financing – exactly what interest rate you get on a single, too. And when your credit rating was lower, you’re likely to get a high rate (and you can after that, a leading payment per month, too).

« In the event that a person’s credit does not be considered them to find the best price, money can be too high to your homeowner’s budget, » Micheletti states. « We’re seeing most borrowing from the bank firming now, also, making it more challenging having property owners so you can be eligible for financing services to discover the best pricing. »

You could potentially usually look at the get via your bank otherwise borrowing from the bank bank. To get the lower costs, you are going to generally speaking want a good 760 credit score or higher.

Yes… if you have a good amount of higher-attract financial obligation

Given that home guarantee fund keeps straight down rates of interest than many other economic situations, they’re able to often be a good idea to own merging personal debt. If you had $10,000 into credit cards that have an effective 21% price, such as for example, playing with a keen 8% house equity financing to repay one to harmony could save you a whole lot within the interest costs.

Charge card prices is variable, also, so your pricing and you will money normally go up. Household equity funds you should never feature that it risk.

« Domestic equity loans give fixed interest levels, » Micheletti states, « to ensure homeowners its rates doesn’t increase for the identity regarding the mortgage. »

Zero… when your income are unstable

In the long run, when you have erratic income and you may aren’t sure you could potentially conveniently accept an extra monthly payment, a home security financing probably isn’t the finest disperse.

Due to the fact Micheletti sets they, « There was a danger of putting their property towards foreclosure as long as they miss payments on financing. »

Research rates for your home security loan

You should buy a home equity loan or HELOC away from many finance companies, borrowing from the bank unions and you will mortgage brokers. To make sure you get the best rate , usually compare at the very least several options.

Examine charges and closing costs, too, and get mindful to simply use what you need. Credit a lot of could lead to unnecessarily high costs, which increases your own risk of foreclosures.