Assets Taxation Exception

Possessions fees finance such things as libraries, flames departments, and you can local roadway and invention tactics. Handicapped veterans’ assets income tax exemptions can be lower the matter you ought to spend in property taxation.

Such taxation exemptions aren’t a national system, and additionally they are different by state, very consult your regional Va place of work to know the latest exemptions you’re eligible for. Specific says promote an exclusion to all the pros, if you find yourself most other states restriction it advantage to veterans who’re already researching handicap payments. Handicapped experts is 100% exempt regarding assets taxes in a few says.

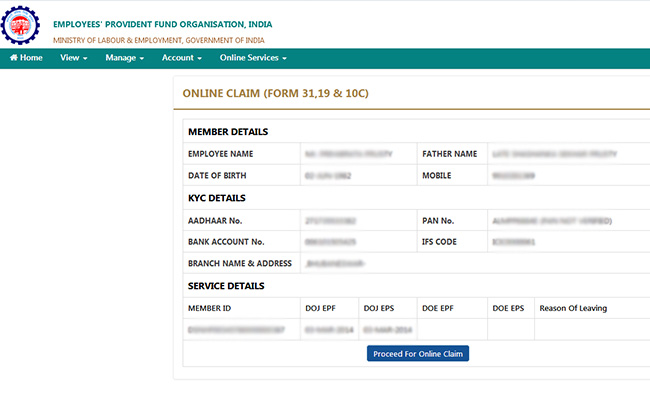

Making an application for a Va financing is like making an application for all other mortgage in lot of areas. Simply take these types of six actions under consideration when using.

step one. Safe a certificate regarding Eligibility (COE)

You will want which to be eligible for the Virtual assistant mortgage. You’ll need to bring proof the armed forces solution predicated on the status.

Tell your mortgage broker you want your own certification regarding qualifications early along the way for them to help you get they.

dos. Get Preapproved

When purchasing property, rating preapproved in the beginning. New acceptance offers set up a baseline to have deciding simply how much you can afford. Simultaneously, after you create an offer into the property, you will find suppliers often just take offers a lot more certainly in the event that an effective page out-of preapproval is actually affixed.

step three. Go shopping for a home

Selecting a property having an effective Virtual assistant mortgage feels as though seeking a good house or apartment with any other mortgage choice. Whatever assets you order need certainly to meet up with the VA’s Minimal Assets Requirements, or MPRs. MPRs guarantee the home is safer, structurally sound and you may hygienic. This type of conditions will vary centered on identified threats inside a place.

When you pick property you adore on the finances, setup an offer to find your house. The seller may accept their offer, reject the deal otherwise counteroffer. When you plus the provider agree with a cost, a representative find out here otherwise lawyer might help draw up a conversion deal.

5. Read Virtual assistant Assessment and you will Underwriting

Underwriters usually assess your finances and make sure your be eligible for an excellent Va loan. The fresh Va may also wanted an appraisal ahead of they accept the fresh new loan. Virtual assistant appraisals was more strict than simply old-fashioned fund. During the a Va appraisal, this new appraiser commonly make sure that your house suits brand new VA’s MPRs which can be sanitary, structurally voice and you can disperse-in ready with just minimal fixes.

6. Close on the Brand new home

Just like the Virtual assistant appraiser says your new house is safe and sound, it’s the perfect time on the best way to sign up your brand new home, get your mortgage and get the secrets to your brand-new property.

The bottom line: Try A great Virtual assistant Mortgage Most effective for you?

An excellent Va loan is a vital work with won by the our armed forces. For those who meet the requirements, you should buy an effective interest with no money off, even though you possess past credit troubles. If you feel such as for example you might be in a position, apply for an effective Va mortgage with Advanced Capital today!

Federal Protect equipment fall under individual claims, generally there isn’t any main listing archive. Contact the new National Shield Adjutant General’s Workplace in the condition in which your supported and request the NGB Setting twenty two and you can 23 so you’re able to ensure you get your COE.

Don’t worry, although. More often than not, if you don’t have the money beforehand, the brand new Va resource percentage is rolled to your home loan.

Handicapped veterans can also be eligible for a temporary Household Type (TRA) give to incorporate improvement on property which make it much easier to help you navigate if you live that have a member of family. Such SAH provides, you won’t need to pay their TRA offer, which makes them an effective tool to possess pros with mobility-relevant disabilities.