thirteen Eligibility – Services Functions Enjoy: ? Single Family members Systems ? FHA Recognized Condos ? Structured Device Developments (PUDS) ? 2-Device properties Ineligible Properties: ? 3-cuatro Tool characteristics ? Were created construction ? Resource properties ? Leasing Home ? Co-ops ? Amusement, travel, or 2 nd land

fifteen SAPPHIRE System Procedure System Breakdown State RestrictionAvailable on the States From California, Las vegas, nevada, Washington, Texas And you may UTAH Only! System Designs ? FHA 29 Year Repaired installment loans no credit check San Jose AZ ? Virtual assistant 31 12 months Fixed Max LTV ? FHA – % ? Va 100% Max CLTVFollow FHA and you can/otherwise Virtual assistant guidelines Limit Loan amount FHA: This new cheaper away from $417,000 (not including MIP) or FHA allowable restriction Va: The latest lower away from $417,000 (including VAFF) otherwise Va deductible limitation Loan PurposePurchase OccupancyOwner Filled Down-payment Recommendations Give : 3% otherwise 5% available Can be used to match the borrower’s equity contribution called for to the FHA step one st Financial, closing costs, pre-paids, Va allowable charges for each Va guidelines

17 Underwriting Assistance TopicGuidelines Underwriting Strategy Deductible underwriting approach: ? Federal national mortgage association Desktop computer Underwrite (DU) welcome ? Need to be chance scored by the FHA Scorecard ? Approve/Qualified recommendation ? Tips guide UW invited FMC Overlays use **Until specifically given, go after fundamental FHA assistance Plus First-mortgage FHA overlays** Lowest Fico scores ? 620 ? Non-Antique Tradelines Not allowed Maximum Loans Proportion ? DU Accepted funds Follow DU approval to max fifty% DTI ? Instructions UW financing Go after buyer guidance also FMC overlays Supplies ? Nothing required Follow agencies recommendations Mortgage In. ? Follow practical FHA MIP

18 Underwriting Advice TopicGuidelines Homebuyer Studies ? Not needed Low-Tenant Co- borrowers/Co-signers ? Banned Present Page ? Gift Letter is necessary, for every single HUD guaranteeing criteria Tax Transcripts ? Realize FMC’s practical 4506-T plan Assets Flips ? Invited Pursue HUD advice Along with FMC overlays

19 UW Recommendations cont’d… TopicGuidelines Vendor Efforts Anticipate up to 6% Present FundsAllowed off relatives Realize 4155 Prepayment Punishment Zero Prepayment Penalty AssumabilityNot acceptance *** Virtually any criteria Pursue FHA 4155.step 1 recommendations In addition to FMC overlays***

FMC comes with the latest offer into the our very own lenders guidelines and we also more cord the amount once we finance all of our loan which means, we no further wait an additional 24 hours to cover a beneficial Sapphire financing

twenty two Restrict Allowable Charges TopicGuidelines Interest rates ? Available on the brand new Scheduling Site, Or the FMC Rate Sheet sets Max Origination Commission ? Contact your FMC Service Party to possess charge and you can settlement Dismiss Charges ? Not one welcome Rebate Costs ? None available Par prices simply Allowable Charge ? Must be practical and you may regular and you may completely revealed on the borrower in line with all companies, federal, condition and you may regional laws – Consider ML 2009-53 to own HUD exception to this rule to itemizing charge ? Get hold of your FMC Service People having allowable charge Program CodeFHA: F30FMP Virtual assistant: V30FMP

24 Financing Procedure Debtor need to meet with the adopting the criteria: 1. 2.FMC Department submits the new completely canned document so you can Underwriting getting loan recognition step three.Upon loan approval, the newest Part are informed to set-aside loans and you can lock loan 5.FMC close/pre-funds 1 st real estate loan six.

FMC underwrites the mortgage 4

twenty-five NHF’s EIN # ? NHF’s EIN #: 42-1549314 ? We are required to reflect NHF’s EIN towards the HUD’s FHA Financing Underwriting and Transmittal Realization together with second money assistance, offers or gift suggestions on the debtor if the debtor gets a keen FHA First mortgage.

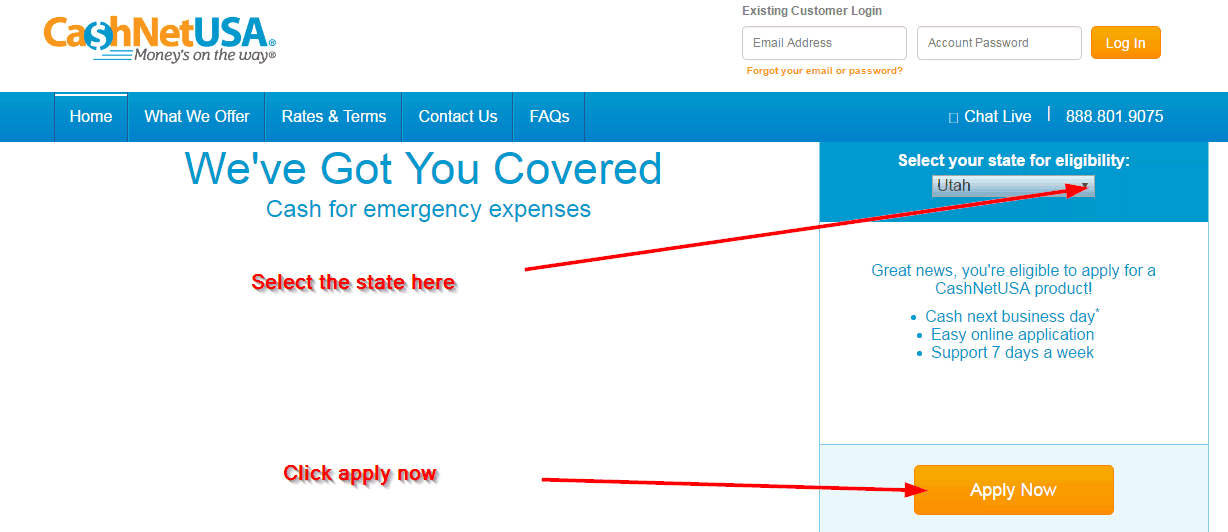

twenty six NHF Booking Webpage Borrower need certainly to meet up with the after the standards: ? Bookings is handled at the FMC Part level utilising the Booking Portal for the NHF webpages nhfloan.orgnhfloan.org ? Brand new Booking Portal might be reached Saturday by way of Tuesday between 9:00 Am and cuatro:00 PM PST. ? In order to access brand new Booking Site, a beneficial User ID can be used. ? You to definitely representative ID and you may Passcode would be allotted to for each department by the Seller Help cluster at FMC. Most of the previous associate ID’s was indeed de-activated. ? This new Scheduling Site commonly choose if or not that loan subscription initial qualifies according to Money and Credit score Limitations guidance provided, and gives an electronic confirmation (Relationship Confirmation) of one’s membership and this must be given on the loan document.