Offset, Proper out of: Banks’ legal right to grab funds you to a beneficial guarantor or debtor might have on put to cover a loan within the default. It is reasonably known as proper off setoff.

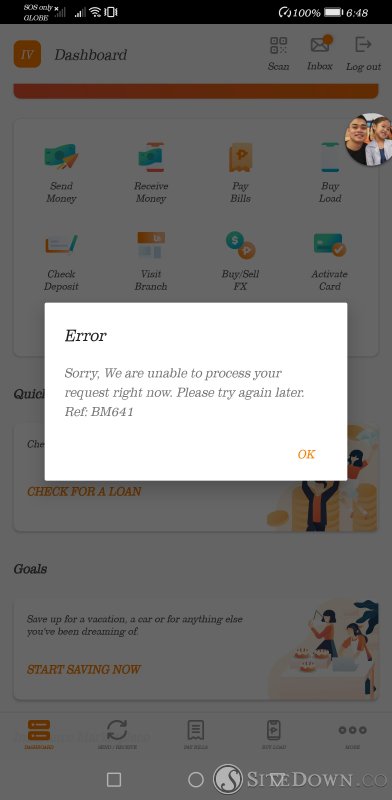

Online Banking: An assistance which allows an account holder to obtain username and passwords and you can create specific financial transactions by way of a computer through the economic institution’s web site. (This will be known as internet otherwise digital financial.)

Open-End Borrowing: A credit agreement (normally a charge card) enabling a buyers in order to borrow secured on a good pre-accepted credit line when selecting goods and services. The brand new debtor is only charged on the count which is indeed lent as well as any notice owed. (Also referred to as a charge account or revolving borrowing from the bank.)

Opt-In: Consent granted in order to a corporate or company to utilize your own email address address having advertisements otherwise marketing intentions, or even to book their current email address to some other team.

Opt-Out: The alternative regarding Choose-In; not granting permission to possess a corporate or company to utilize their current email address to own advertising and marketing or sale intentions, or to lease the current email address to another team. Option Period: Within the Texas, an alternative months is the limited time where a vendor regarding a property might not to market so you’re able to somebody besides the person otherwise entity exactly who put a bid. This gives the possibility client time for you carry out inspections as opposed to setting his/her serious money at stake. The potential visitors pays a non-refundable option commission so you can make the most of an option period.

Overdraft: When the amount of cash taken out of a bank checking account is actually more than extent in fact in the account, the additional is named an enthusiastic overdraft, while the membership is said as overdrawn

Participating Community: A residential area wherein the fresh Government Crisis Administration Institution (FEMA) possess licensed new purchases out-of flood insurance according to the Federal Ton Insurance policies System (NFIP).

Passbook: A book when you look at the ledger setting in which is registered most of the places, distributions, and you may income out-of a consumer’s savings account.

Past-due Product: Any notice or any other go out instrument off indebtedness who has not been paid off toward deadline.

Patch: A special application discharge designed to enhance a software system. Status start around coverage, efficiency, otherwise efficiency improvements.

Private Character Amount (PIN): Generally a several-profile number or phrase, new PIN ‘s the magic code provided to borrowing from the bank or debit cardholders helping them to availableness its membership

Payday loan: A tiny-buck, short-term loan you to a debtor intends to pay-off out of their 2nd income or put out of fund.

Rewards Declaration: A formal declaration prepared when that loan benefits try contemplated. It suggests the present day updates of your loan account, all the figures due, as well as the each day interest rate.

Unexpected Price: The interest rate discussed in relation to a certain number of date. The fresh monthly unexpected rates, instance, is the price of credit four weeks; brand new each day occasional speed is the price of credit every single day.

The code is actually both at random assigned because of the financial otherwise chose because of the buyers. It is designed to stop not authorized use of the credit whenever you are being installment loans San Francisco CA able to access a financial services terminal.

Pharming: Pharming takes place when pages enter in a legitimate Hyperlink and you can you are dishonestly rerouted so you’re able to an internet site that isn’t genuine so you can need information that is personal through the internet like charge card wide variety, family savings guidance, Personal Security count or other sensitive information.

Phishing: The whole process of looking to receive personal data dishonestly using email otherwise pop-up messages so you’re able to cheat your with the disclosing the borrowing cards wide variety, checking account advice, Societal Protection amount, passwords, or other delicate guidance.