Soon after you located your loan pre-approval, anticipate to get a hold of records getting good conditionally recognized home loan. You to position was on the best way to receive something special letter. This occurs an individual helps you help make your buy, typically because of the chipping to your deposit pricing.

If someone else was helping you, it’s best to inquire about the new financial support far ahead of time. Deposit they. Allow it to 12 months in your be the cause of over two (essentially three) membership comments. By doing this, in case the financial professional asks observe the quality a couple months off financial statements, the bucks is nothing the latest.

However gift import is on your current bank comments, your mortgage pro often consult a conclusion. Exactly how performed those funds infusion will your money? What is the way to obtain money?

Just what something special Letter Is to Include

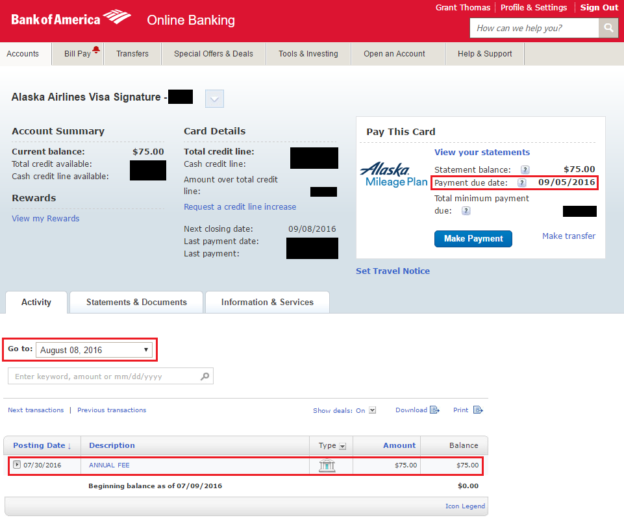

The newest current letter is a simple, one-webpage statement laying out the key specifics of the money transfer. Their mortgage specialist will give you a layout to the page. Conserve lender facts: an image of the newest look at and the transfer in the provide donor’s family savings.

Your own mortgage expert can get consult most of the paperwork tracing new transfer, and could ask for a lender statement from your own donor. As to the reasons? The lending company wants to see the history of the funds within the the account it originated in. It seems that currency could have been legitimately received.

- A title on the top, certainly to provide the fresh file due to the fact Gift Letter.

- The donor’s name, done target and you can phone number, and you will link to the fresh borrower. Who is oftentimes qualified? Anybody relevant from the blood, wedding, use otherwise custody, wedding, or residential partnership. Not any party active in the a house purchase.

- The amount of the fresh present.

- The new target of the home are purchased.

- The new provide donor’s way to obtain loans: title of your own standard bank; membership count and what kind of account its; therefore the date on which a financial evaluate into is (or would be) gone to live in the loan applicant’s escrow membership.

- New dated signatures of your own gift donor and home buyer.

Main of the many: The fresh new donor are signing a statement that zero payment, in a choice of currency or services, is expected. The lending company must be yes (a) you payday loans Elizabeth aren’t and when an alternate personal debt whenever getting the money; and you may (b) the current donor has no lienable claim from the assets.

There’s a common-experience reason to have (b). You just need to imagine like a loan provider to determine they. The lender, who has to get rid of exposure, can potentially thought a conflict along the currency at some point shortly after closing. Let’s say the fresh argument triggered the person who offered your the bucks and also make a state on domestic title? A gift letter demonstrates that new donor simply you to definitely – possesses zero vested interest in the value of our house.

As to why something special Letter Have to be Sincere

If you need to spend the money for cash return from the some later time, it isn’t something special. The fresh underwriter needs to amount it as debt in your personal debt-to-income (DTI) proportion.

Zero chain affixed? Then your donor is always to invest in complete a present page. Towards the bottom, there’ll be a gap for both donor and you will person so you’re able to certify the realizing that it is a national crime, with serious penalties, in order to consciously misrepresent their purposes.

Here, a borrower might query exactly how people perform know. And how create some body maybe costs a great donor otherwise person which have a federal crime once the bargain is over?

It will occurs. Folks have employment losings, nearest and dearest issues, scientific events, or other events conducive to help you monetary setbacks. Specific financing belong to financial standard. Some home owners face foreclosures or case of bankruptcy. On unfortunate knowledge off suit, process of law have a tendency to see papers this new resident accustomed obtain the financial. Incase misrepresentations have been made, they’re going to emerged.

Consult with your home loan specialist regarding better sorts of mortgage to suit your condition, as well as your purpose to utilize present finance. To possess a standard idea, the most popular version of fund implement such requirements:

- Conventional fund because of Fannie mae and Freddie Mac: A present away from a member of family normally finance a complete down payment getting a first house. Freddie Mac computer and allows mortgage applicant to use present marriage present money from family relations and you may family relations.

- New Federal Construction Government (FHA): A gift of cash is suitable regarding a close relative, union, company, close friend, or nonprofit team. The cash is also acquired of a public organization you to definitely supports first-big date homebuyers or lowest- to help you moderate-money customers.

- Company out-of Experts Activities (VA)and you will U.S. Company regarding Agriculture (USDA) loans: Va and you will USDA loans officially don’t require a downpayment. Gift suggestions and you may provide letters remain commonly permitted to loans down repayments of these commands.

In short, very mortgage loans accommodate current money to pay for a complete down percentage into an initial quarters. Financing guidelines is more strict to the orders off money functions.

Pro idea: The bank may also make it easier to have fun with provide money for mortgage reserves, if you are obtaining a traditional mortgage. Current currency over and above the requirements toward down payment tends to be led to supplies within the an FHA financing. Pose a question to your financial expert or financing officer having most recent information to help you suit your very own disease.

Tax Considerations to own Current Donors

When the giving more $15,000 ($29,000 getting shared filers) to the you to definitely recipient, brand new donor should state this new current with the Internal Revenue Services. When processing tax returns towards the season the new provide page try signed, brand new donor is to make use of the government current reporting mode so you’re able to declaration the newest transfer from finance.

This new donor would not shell out income tax towards the provide currency. However, offering does have income tax implications, about in writing. Its deducted from the existence gift amount a person could possibly get give taxation-free. Thus, the newest donor should seek the advice of a taxation top-notch having advice.

A few Latest Conditions on Smart

After you’ve the conditional approval, avoid and make big places into your levels (such an unusual put of over 1 / 2 of your monthly earnings) up until when you close on the the new possessions. Remember that loan providers reexamine your own property in the event the 60 days go by since they earliest examined your a few months out-of lender comments. Higher deposits to your family savings also are causes.

It is advisable that you have fun with something special (and you may something special letter) only when you really need it to obtain a loan. Additionally, it is advisable that you comprehend the provide letter’s purpose off a great lender’s perspective. Which expertise can help you avoid court issues. It also helps you get your final financial approval…directly on date.