The loan approval procedure might have been good tuned of the contractors and you can lenders, as it is something they help people with often

If you have never ever financed a roof, do not get spooked you’ll find benefits to this and it’s really maybe not an emotional processes. Understand that after you financing, you get one thing a great a different sort of rooftop for your house, which is possibly the biggest capital possible make that you experienced and you may securing they with a new roof merely is practical. Listed here are the brand new advantages you really need to focus on while contrasting your options.

In the event your borrowing is good while lover towards the proper bank or perhaps the right roofing contractor, you could make use of a no-attract rooftop funding choice

Roof today and pay later: That’s what roof financial support concerns. Unlike wishing unless you enjoys loans saved up, that will capture extended and sets you at stake off significant possessions ruin if your rooftop is dripping, you can purchase the project already been today.

Is the wet season just around the corner? You should get this new rooftop repaired before you could exposure wetness harm to the within of your house. Funding your roofing system venture will provide you with immediate access to loans to obtain the investment started and you can completed until the storms strike.

The fresh terms and conditions toward 0% roof financial support fund may vary, but some enjoys an excellent a dozen-few days repay time frame, and that’s lots of time for many property owners to invest back its roof financing.

At VIS Outside, you can expect a several-day, no-focus choice. When you take this 1 you never spend any costs, which means that there’s no attract to bother with you might be merely paying for the price of the project.

In the place of love plunking off large sums of cash the week for a loan tied to your roofing system venture, take advantage of reasonable payment per month arrangements giving you monetary independence. Which have quick, sensible payments, you could potentially chip away at your mortgage rather than have the weight away from creating a huge lump sum of money from the a given date.

Just like the a different roof builder, VIS Exterior can give money thanks to EnerBank, that provides our very own customers the advantage of low monthly premiums.

When considering a no initial payment and no appeal solution, this may usually involve repaying the degree of the mortgage inside a preliminary timeframe, perhaps only six otherwise 12 months. So, whilst you don’t Indiana title loans IN need to put money right down to get the works already been, even though you won’t getting associated with a monthly payment, you happen to be necessary to pay the complete count into the a beneficial quick screen of time, and that is hard to accomplish with limited funds, nevertheless the upside is that there are not any even more fees tacked on your equilibrium.

You desire some time prior to starting to make costs on your the newest roof? Particular lenders gives clients brand new versatility of zero payments more a set time. To have residents who are short to the bucks, thus giving all of them specific control in order to develop reserves and you will/or perhaps to build monetary plans on payment period, the fresh new regards to that will be any is wanted to ranging from the lending company together with homeowner.

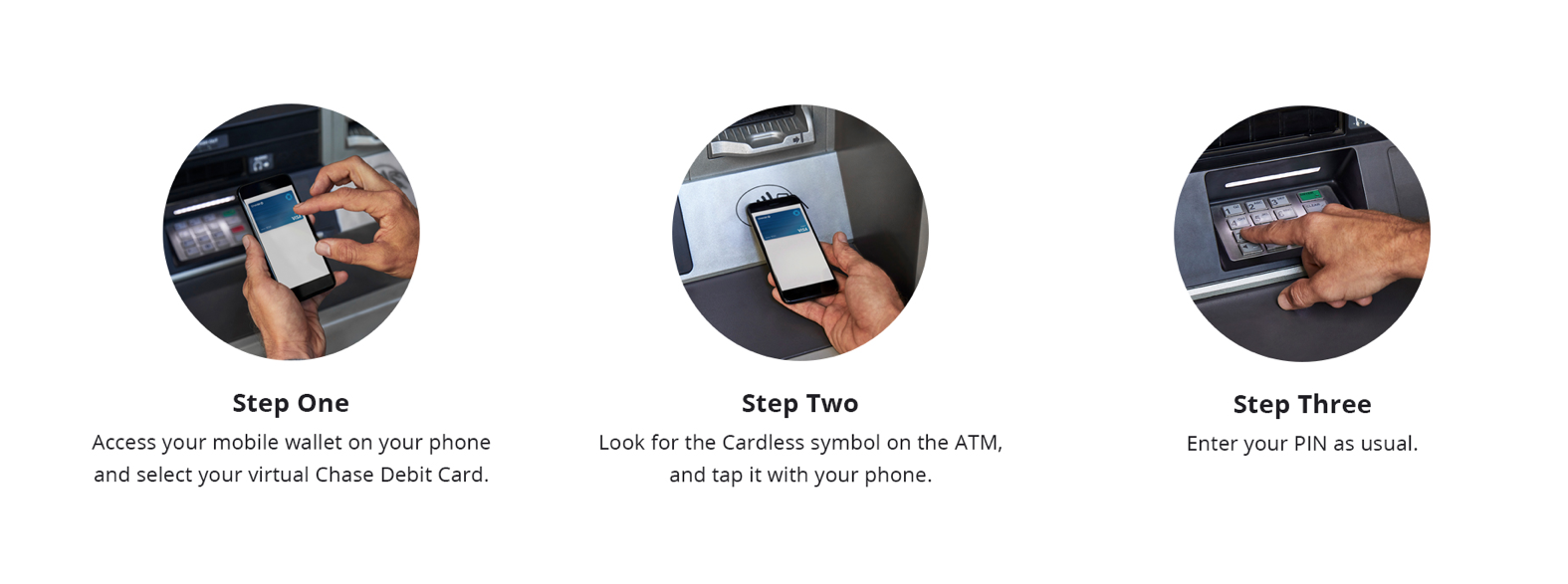

Money applies getting online actually into mobile devices. When you’re hotter talking they completed with somebody, it’s also possible to make use of your mobile and possess assistance from a beneficial capital elite group. You need to be happy to provide the required guidance and a signature and you are put.