If you are looking to get property, you normally sign up for financing from a home loan company. While you are mortgage loans is the conventional answer to acquire to possess property purchase, it’s also possible to have often heard out-of supplier investment. It individual plan anywhere between a purchaser and a merchant varies off a classic financial in manners.

What’s merchant investment?

Vendor money is actually a personal deal between visitors and you will supplier in which the owner stretches money on buyer without the wedding off a lending institution. For the a merchant funding arrangement, the newest terms of our home loan is decideded upon individually anywhere between the customer together with seller, who in addition to acts as the lender. From the lack of a third-party financial, the newest terms of owner financial support arrangement may vary commonly out-of case so you’re able to circumstances.

The theory is that, vendor funding can apply to the home purchase. Used, although not, it constantly pops up under specific conditions. First, the seller typically must keep high collateral at home they’re attempting to sell, otherwise very own your house outright. When your lender continues to be the head owner of the house, it’s unrealistic the vendor commonly acquire approval having an exclusive deal. Next, the buyer can often be (though never) anyone who has think it is hard to safer a normal financial, for reasons uknown.

Provider financial support may also arise because an aspect whenever attempting to sell a good domestic so you’re able to members of the family otherwise nearest and dearest, or when the functions already if you don’t discover each other.

How does supplier financial support works?

Because provider money try a private arrangement, owner and you will consumer need certainly to interact to-arrive contract towards new terms of the loan, from the price towards the commission plan.

With all this liberty, style of merchant investment will are different commonly. The simplest arrangements are usually most of the-comprehensive, meaning that the vendor expands the loan toward complete pick rate, minus any downpayment. This plan is perhaps nearest so you can a conventional mortgage, but in this case the seller – in the place of a loan company – was pretending directly as the bank.

Residential property deals is actually an alternative prospective arrangement. Into the a land package, the consumer and vendor agree on some kind of joint ownership of the property, have a tendency to before finally payment is established. At this point, ownership of the house generally speaking transmits outright for the consumer. Particularly an arrangement deliver the buyer a chance to create security regarding the assets, increasing its probability of protecting a traditional mortgage towards the bottom of repayment title. The buyer can also need certainly to subscribe assets repair and you will fixes during this time.

Lease-choices are another plan. Inside circumstance, the consumer lifestyle just like the a tenant in the property. But not, in place of antique tenancy, the latest occupant retains the possibility to buy your house shortly after good preset timeframe.

Hybrid plans, where a lender remains with it, are present as well. Having a great ple, the seller gives area of the price, with the rest covered by mixture of a conventional financial and you may the latest consumer’s down payment. Assumable mortgage loans, in which the seller’s an excellent funds toward assets move into the fresh new client, may also be it is possible to in some instances.

The latest appeal of vendor funding

Into the buyer, among the many upsides out of a merchant-funded financial try a path to financial support once they could possibly get if you don’t have trouble protecting a vintage mortgage.

A unique possible attractiveness of provider resource is the cousin diminished authoritative supervision. Such as, consumers and you may sellers reach individually discuss the information of your cost therefore the size of the latest down-payment. They could together with avoid the categories of closing costs one to a beneficial antique mortgage usually requires, including any potential duty toward consumer to order private mortgage insurance. In addition to, without financial institutions inside it, the purchase in itself could possibly get move along faster.

Because of the possible price and you may independence of one’s plan, seller resource can also help the https://elitecashadvance.com/loans/loans-for-550-credit-score/ property owner get more prospective customers for their property. Providers may forget deciding to make the categories of solutions generally speaking informed when getting ready a home for sale.

Provider financial support dangers and you may downsides

As with any credit contract, vendor financial support boasts risks. As opposed to a traditional financing, both the consumer and you may provider are typically at the mercy of a lot fewer courtroom defenses, especially in the big event off an installment standard or foreclosure proceedings. That it relative not enough legal protection can cause high headaches during the case of a dispute involving the signatories.

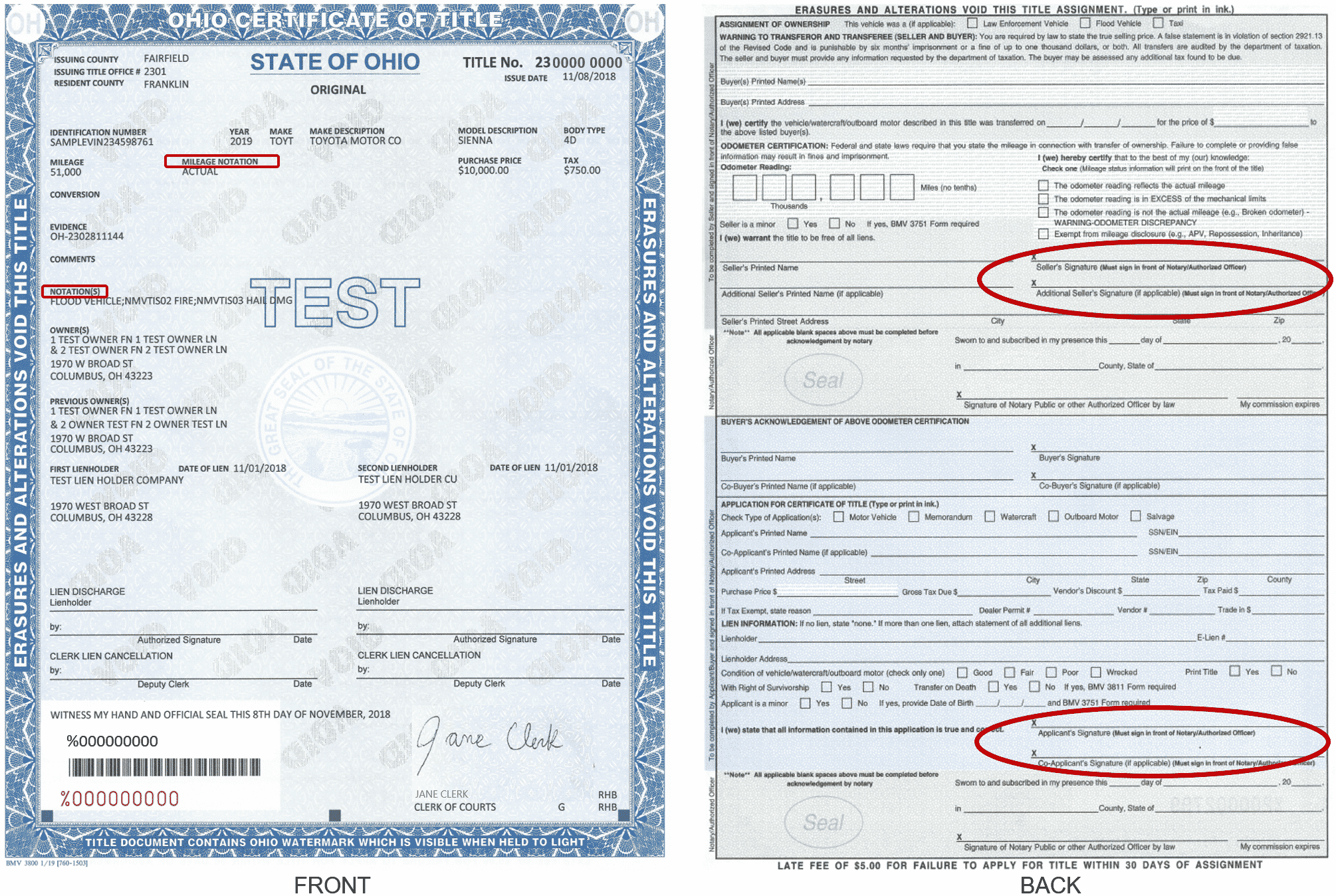

A special possible downside is the records in itself. In a vendor financial support arrangement, it’s the duty of one’s merchant, in conjunction with the visitors, to generate the brand new legal arrangement. If you are both parties could possibly get keep the features from a genuine house lawyer to aid draft the newest terminology, there is no lender on it so you’re able to watch its execution.

On top of that, responsibility for controlling the import of the property’s title and you may ordering a name search sleeps into vendor plus the client correspondingly. At the same time, the repair of the mortgage loan – producing expenses, event payments and you may chasing unpaid number – sits directly to the seller’s arms.

To the customer, there are potential after that disadvantages. Possibly one of the largest is that vendor investment commonly concerns large interest levels than just a traditional mortgage. People highest rates are usually a purpose of the other chance the vendor was taking on since financial regarding the relationship. Consequently, even when a purchaser saves for the settlement costs and you can prevents purchasing private financial insurance coverage, they could still see they spend significantly more finally. Also, once the vendor resource doesn’t typically want a property assessment, there was a chance the client might end right up investing a lot more than market price towards domestic.

Old-fashioned financial vs provider financial support

One last biggest distinction is the build and you will time of new mortgage alone. Antique lenders will often have fees periods away from 15 or 30 many years. Which have supplier-financed mortgage loans, five years is actually a very prominent name, even when the arrangement is different.

The mortgage by itself can be organized differently, having an excellent balloon percentage possibly owed to your the conclusion the new name. To meet up the brand new regards to any balloon commission, the buyer may prefer to search money during the time through a timeless financial. From this point, alterations in the fresh customer’s borrowing or perhaps in the appraised worth of our home could help the consumer secure conventional capital.

Bottom line

Merchant resource may possibly provide a route to home ownership to have people who’ve troubles protecting a conventional mortgage. Although not, these types of private plans have threats and will set you back of their own. Whenever deciding what’s the proper approach for you, it’s helpful to fully envision most of the issues and find qualified advice.