It will take lengthy to get the best house to possess your, therefore means multiple vacations about area to get into various societies and you may rentals. When you’re thinking of buying a house which have home financing, you’re going to have to proceed through a unique round regarding group meetings for the bank, which will encompass multiple layers out of paperwork and you will records. Henceforth, House Earliest Finance company has introduced digital alternatives in the home mortgage category to help you simplify the entire process of obtaining an excellent financing.

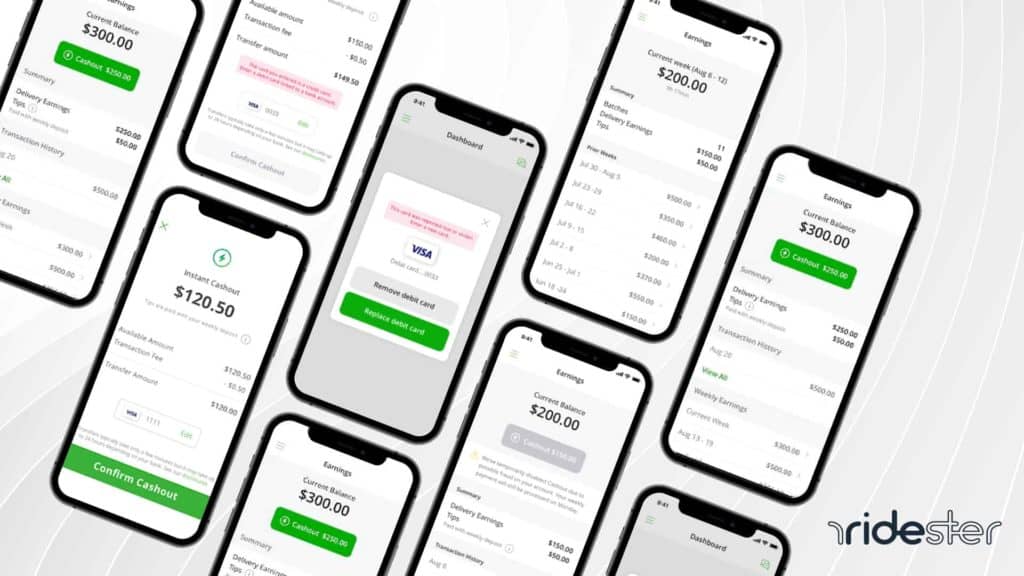

Domestic Very first Finance company activities Express Finance to really make the financing process quick and you will straightforward. It is possible to sign up for a home loan on the web on when and you may of one area.

After you complete your application on the internet, you’ll receive quick acceptance. HomeFirst allows you to get that loan sanction in just 5 simple actions. The service offers a preliminary Sanction Page, about what you could potentially get a loan.

1: Make certain your bank account | Step two: Talk about your revenue details | 3: Identify your property details | Step 4: Render the contact information | Step 5: Score financing give

Attributes of HomeFirst Financial

- It may be recognized in only a few clicks.

- At this time regarding mortgage approval, no files are required.

- Better corporates can also enjoy a new running contract.

- The order is actually paperless, additionally the whole household application for the loan process is carried out online.

Qualifications for Mortgage

Credit score/Credit report: Typically, loan providers want to lend so you can applicants having credit scores from 750 or a lot more than. For example loan individuals features a much better likelihood of providing mortgage loans with reduced rates of interest.

Ages of brand new Candidate: Fundamentally, a decreased decades to try to get home financing try 18 decades, and also the restriction years during financing readiness is 70 many years. The newest repay date is typically around 3 decades, with several loan providers capping the age of later years while the maximum many years restriction.

Earnings and a career: A leading money ways a heightened power to pay-off a loan, implying a diminished exposure into the lender. Because of their higher-earnings predictability, salaried team typically have a far greater threat of getting mortgage loans within straight down rates.

Installment Strength: Banking companies and you may HFCs have a tendency to accept house loans to help you applicants whose entire EMI relationship, such as the suggested financial, will not exceed 50% of its full earnings. Since the opting for an extended loan months decreases the house loan EMI, people which have decreased loan qualifications is finest the state by choosing a lengthier period.

Property: When choosing home loan qualifications, loan providers check out the property’s shape, strengthening characteristics, and you https://simplycashadvance.net/personal-loans-or/ may ount which can be provided to your property. The absolute most a loan provider can offer towards the a homes mortgage try not to meet or exceed ninety per cent of one’s property’s worthy of, according to RBI recommendations.

Records Required

Discover home financing, an applicant ought to provide enough files creating its KYC, brand new antecedents of the property they attempt to pick, their income record, and the like, depending on and that buyers category they fall under (salaried/professional/businessman/NRI).

The latest files required differs from you to definitely lender to a higher. Listed here are several of the most typical data needed for a mortgage from inside the India.

Just how to Incorporate?

Early trying to find your dream home, you should have an idea of exactly how much of a property financing you would certainly be entitled to centered on your income. It does help you in and then make a monetary judgment regarding your family you desire to and acquire. You can make use of the borrowed funds qualification calculator to determine simply how much currency youre eligible to. As assets could have been done, you may want to check out the HomeFirst webpages and you may complete the fresh inquiry setting locate a visit straight back in one of one’s Counsellors. You can read this information more resources for financing terms, or this information to know about the latest documents needed for loan programs.

On the more than recommendations in hand, one can obviously address the problem from exactly how much house loan one could to get based on his or her money and take a big step into purchasing the dream family.