She’s got did in several metropolitan areas level cracking information, government, knowledge, and a lot more. Their particular possibilities is within private financing and you can expenses, and you can a home.

What’s a secondary House?

A vacation house is a vacation hold, apart from the brand new customer’s dominating home, that will be put generally to possess leisure intentions along with getaways otherwise vacations. Known as a leisurely or additional assets or house, a vacation residence is usually based in a separate area out-of this new owner’s number americash loans Alamosa one house. As trips belongings are only used in the certain times of the year, of several people rent out such dwellings when they are not using them.

Secret Takeaways

- A secondary home is a property besides a person’s first house, which is used only for vacationing.

- A vacation house is will located specific range away from the first home.

- A secondary assets can be rented out over produce extra money if it is not being used.

- Discover operational can cost you to help you buying a secondary home regardless if that you do not live in the home such assets taxes, insurance, fixes, and you will attract with the mortgage loans.

- A good timeshare is actually a typical example of a vacation household that’s mutual and owned by numerous someone, per which have an engineered time period when they may use the house or property.

Information Travel Belongings

Home is put into several different kinds, constantly to have taxation purposes. The home you to a homeowner lives in is referred to as the prominent or number 1 home. So it property are going to be a house, apartment, condominium, otherwise truck. So you can qualify while the a primary home, the latest citizen-whether which is a single individual, several, or a household-need certainly to real time around for the majority of the season.

A holiday family, while doing so, is a lot some other. These types of house is have a tendency to reported to be the next house. Oftentimes, it is within the yet another location than the user’s top, dominant household. While the indexed a lot more than, the owner are able to use it assets getting relaxation motives together with getaways, always for most months or days yearly. Just like first residences, trips land takes any kind-typically the most popular getting cottages or condos.

New difference in first residence and you can travel possessions are an excellent blurry line to people, particularly if they invest a considerable amount of amount of time in one another urban centers. Yet not, new distinction is very important for a few monetary things.

Renting Trips Possessions

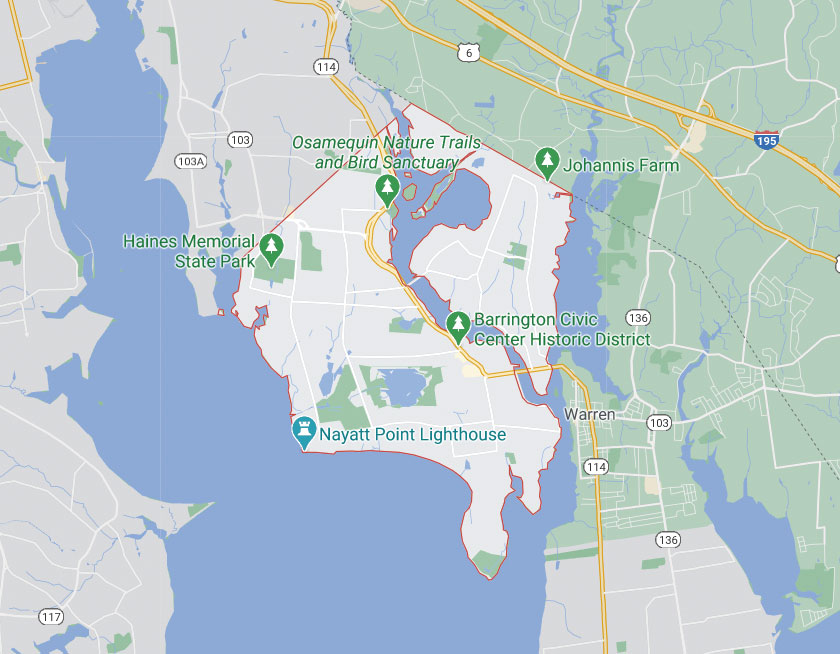

Besides providing the citizen having a destination to break free, trips functions can also be hired out over build a lot more earnings while they are not in use. In this case, two having a primary household into the Maine get very own a beneficial vacation family from inside the Florida. The happy couple will get check out the Florida house during the Maine’s coldest weeks whenever you are renting it out to other anyone for the remainder of the entire year.

Regardless if they truly are an effective resource to have, trips property is a monetary difficulty. For instance, a mortgage towards a secondary family possess increased appeal speed than just that loan into an effective homeowner’s top home. That’s because the particular owner might have increased risk of standard since the men and women are the most likely to store its number one residence than just a temporary one out of the event of a bounce out-of luck. People who own travel property can be taking up the second home loan in the event the financial of your own first assets has actually yet , so you’re able to be distributed regarding yet.

This form of resource is even high-risk in terms of the potential for rental earnings. Renting aside a vacation property does not offer steady or consistent cashflow; even when the home is during the an appealing place, most travel property renters tend to service quicker-term users than the tenants otherwise long-name customers. Therefore, landlords off vacation possessions need prepare for possible income shortfalls and you can be accessible so you’re able to part of and you may pay for expenditures not safeguarded by leasing money.